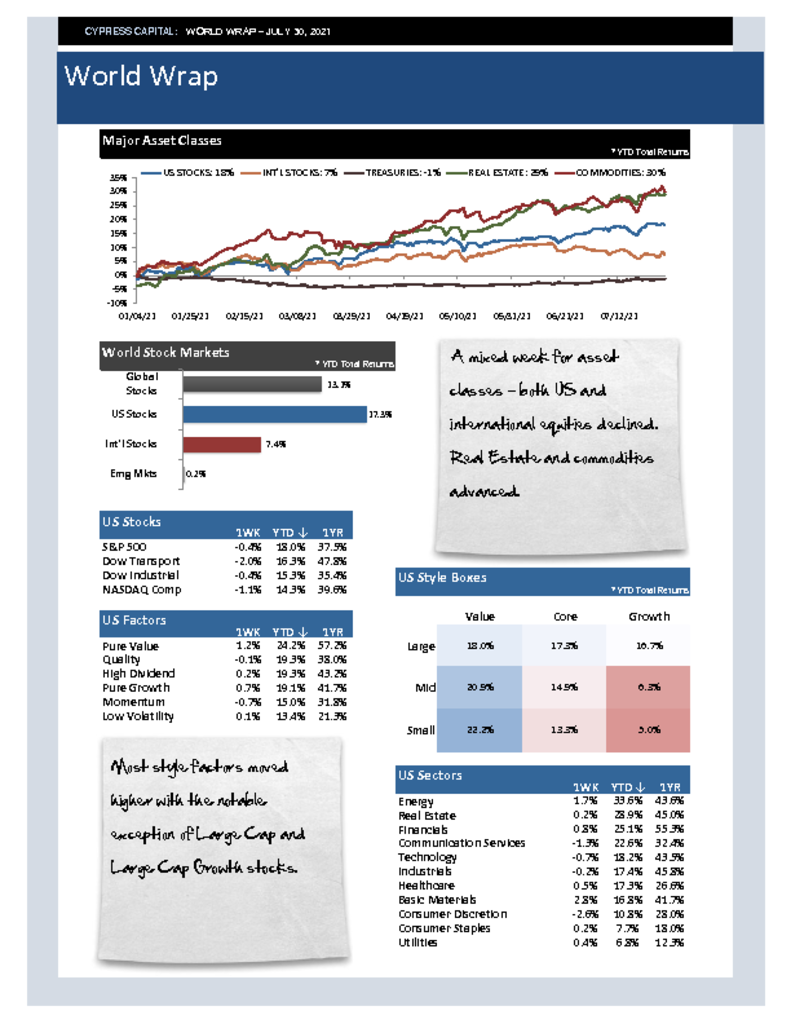

– A mixed week for asset classes – both US and international equities declined. Real Estate and commodities advanced.

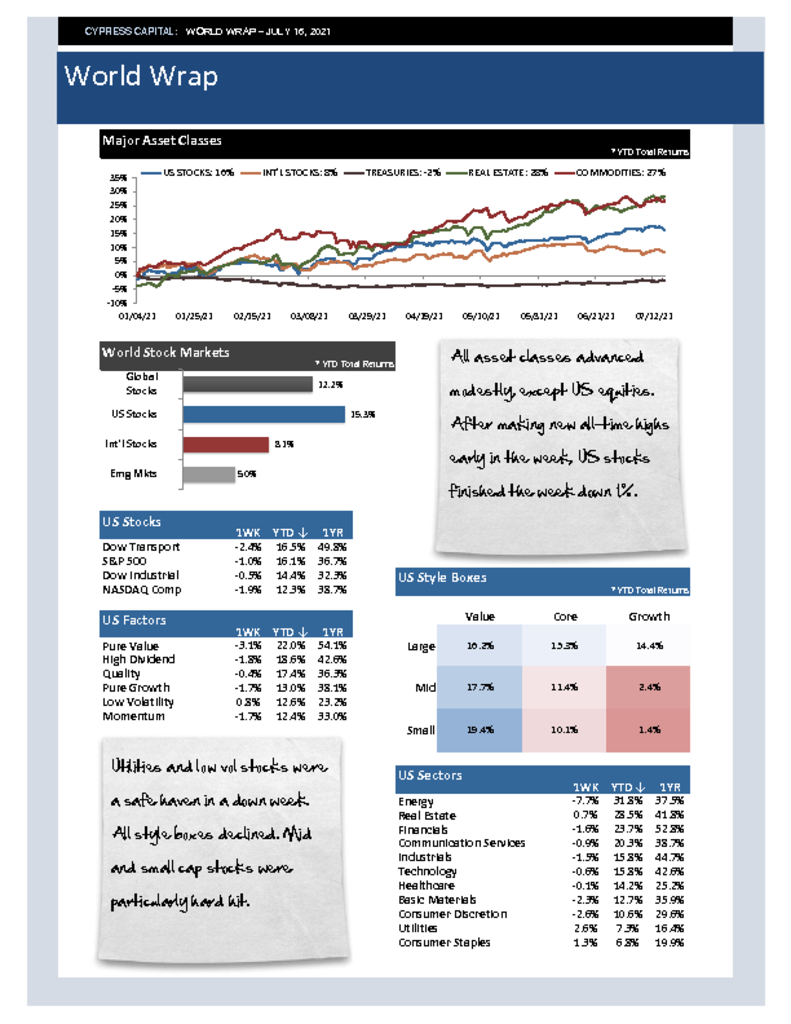

– Most style factors moved higher with the notable exception of Large Cap and Large Cap Growth stocks.

– It was another difficult week for emerging markets, weighed down by China. China declined more than 6% and is down 12.3% ytd.

– A short squeeze and positive comments from Elon Musk pushed Bitcoin higher by 20%.