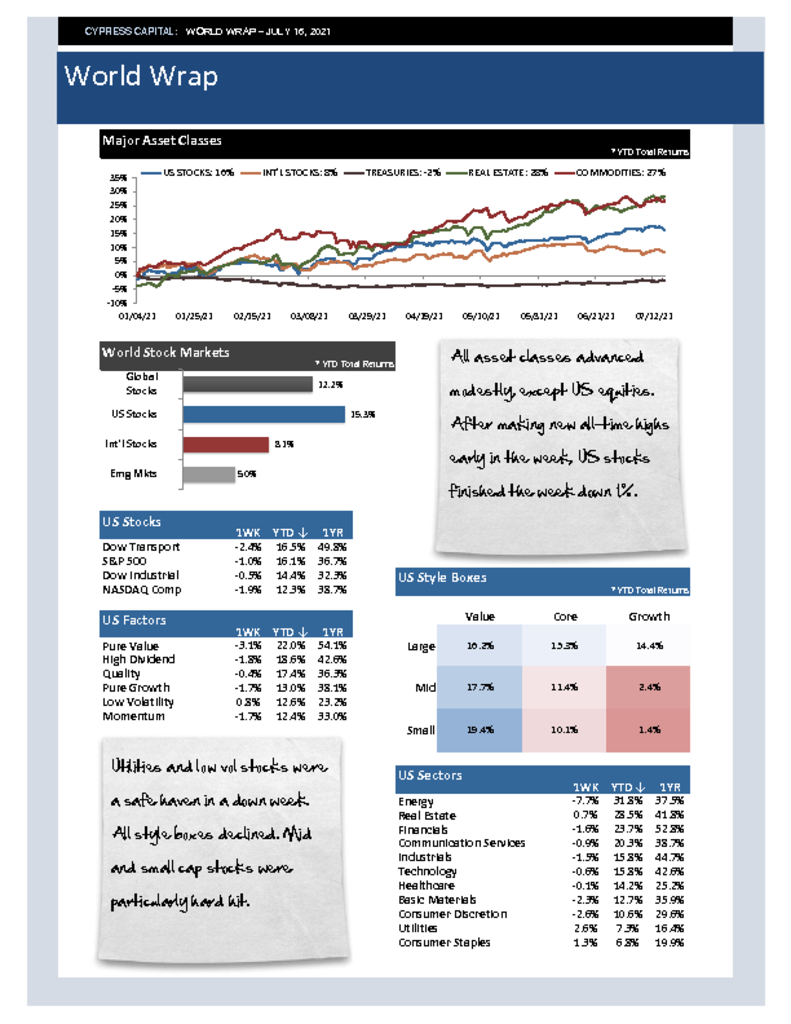

– All asset classes advanced modestly, except US equities. After making new all-time highs early in the week, US stocks finished the week down 1%.

– Utilities and low vol stocks were a safe haven in a down week. All style boxes declined. Mid and small cap stocks were particularly hard hit.

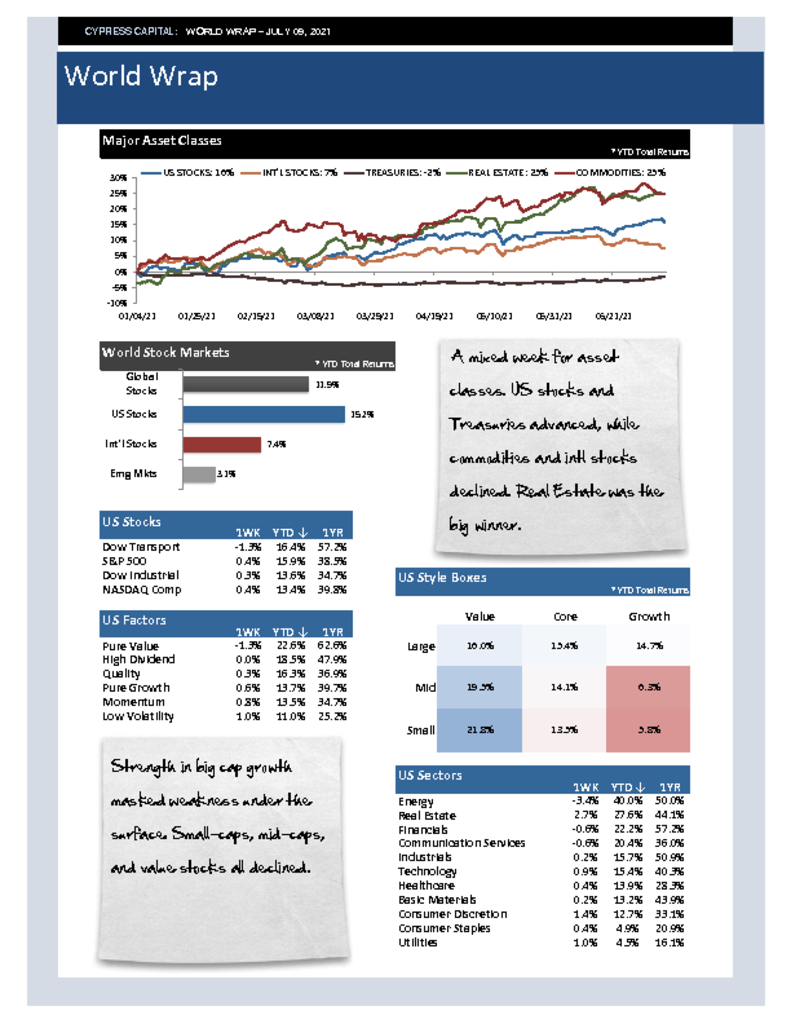

– Emerging market stocks advanced 1.7% as China continues to dance to a different beat. Chinese stocks advanced more than 2% but are still down 3% ytd.

– Lumber prices fell more than 20% last week and are down almost 70% from the all-time-highs in May, bringing the 1yr return down to 2%.