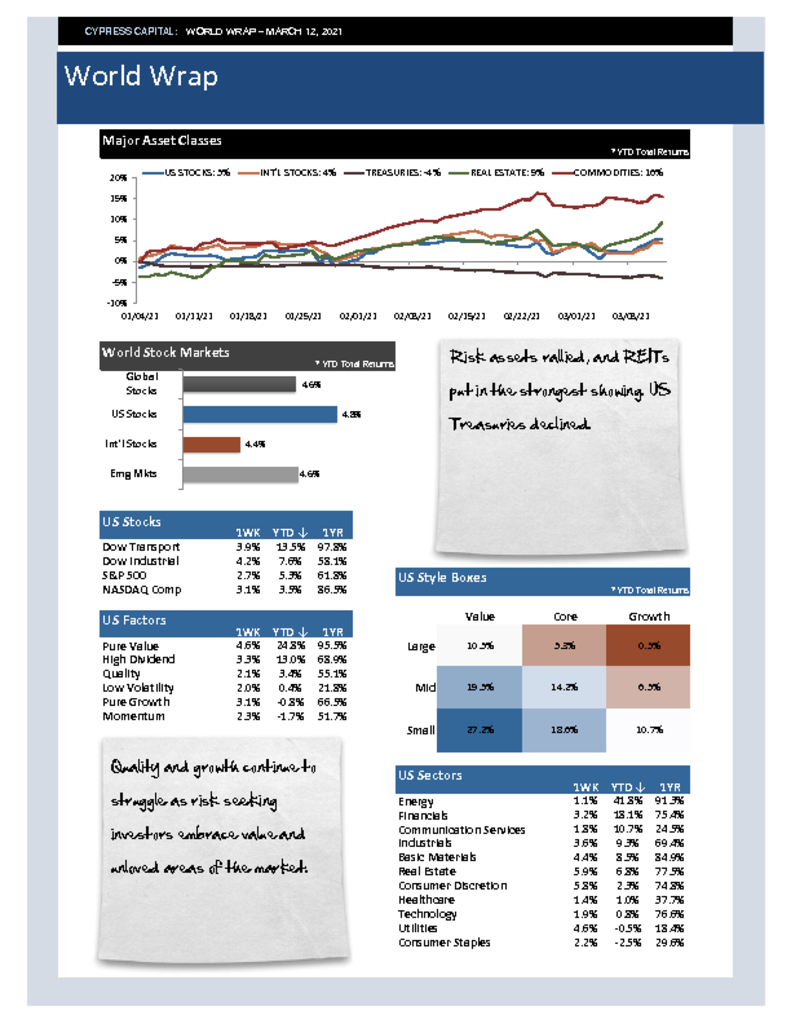

– Risk assets rallied, and REITs put in the strongest showing. US Treasuries declined.

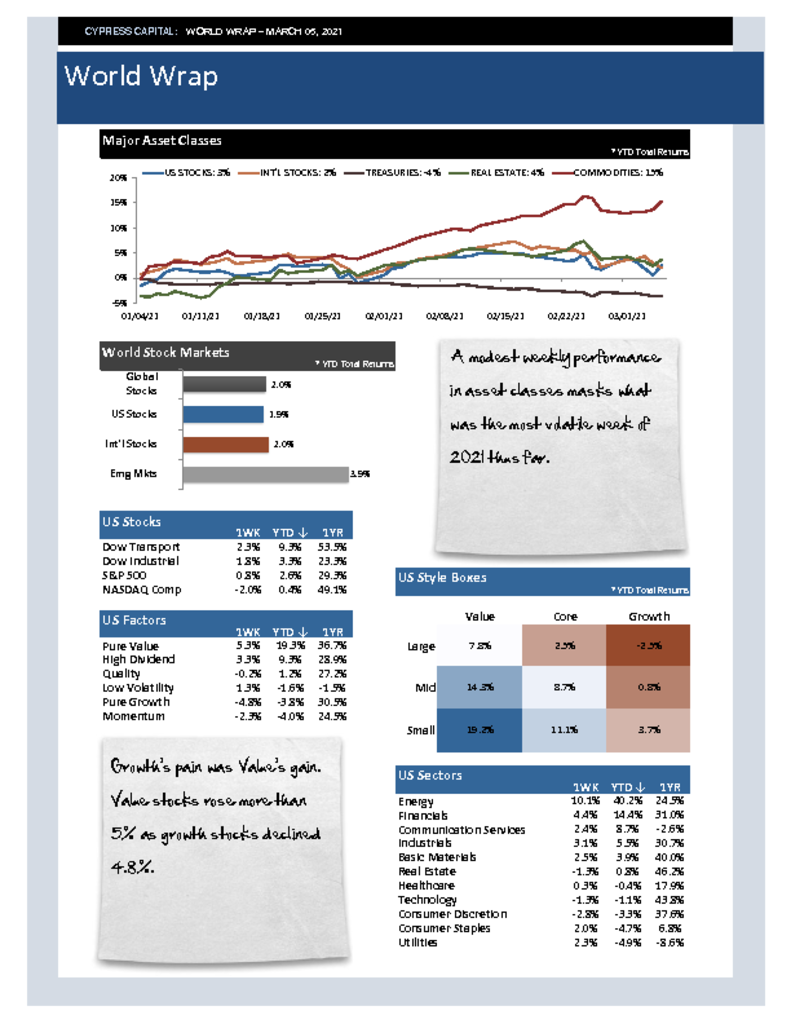

– Quality and growth continue to struggle as risk seeking investors embrace value and unloved areas of the market.

– Developed markets beat emerging markets. Weakness in Chinese equities continue to weigh on emerging market indices.

– Treasury yields have reached levels that have stabilized the US dollar, but there are still no short-term signs that yields have stopped rising.