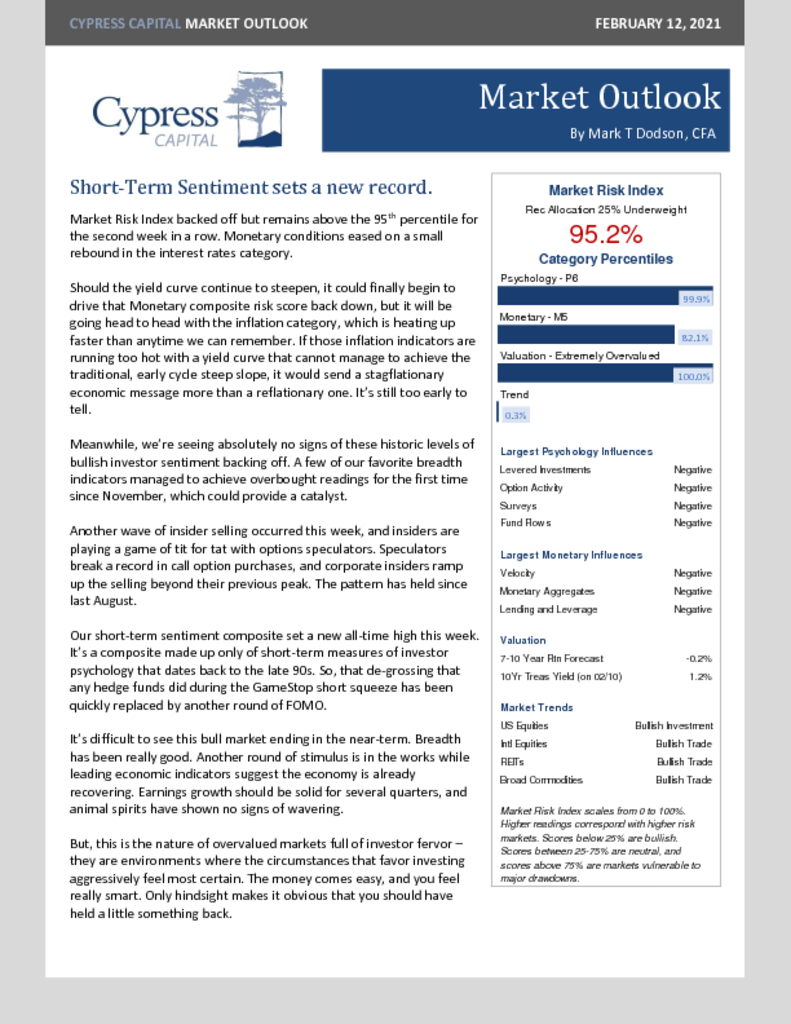

– Corporate Insiders keep selling what retail traders are buying.

– Market hits overbought levels for the first time since November.

– Corporate Insiders keep selling what retail traders are buying.

– Market hits overbought levels for the first time since November.

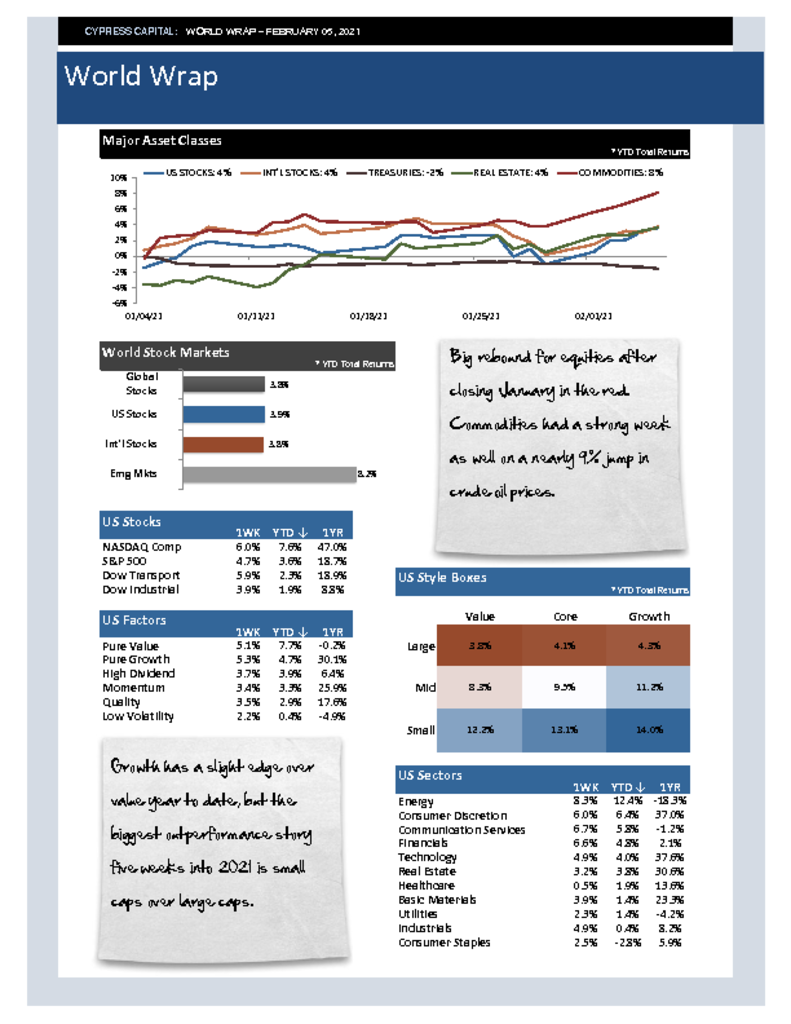

– Big rebound for equities after closing January in the red. Commodities had a strong week as well on a nearly 9% jump in crude oil prices.

– Growth has a slight edge over value year to date, but the biggest out-performance story five weeks into 2021 is small caps over large caps.

– Emerging markets have opened a sizable performance gap over develop markets.

– After bottoming on January 5th, the dollar put in a short-term higher high this week, the first since last summer.

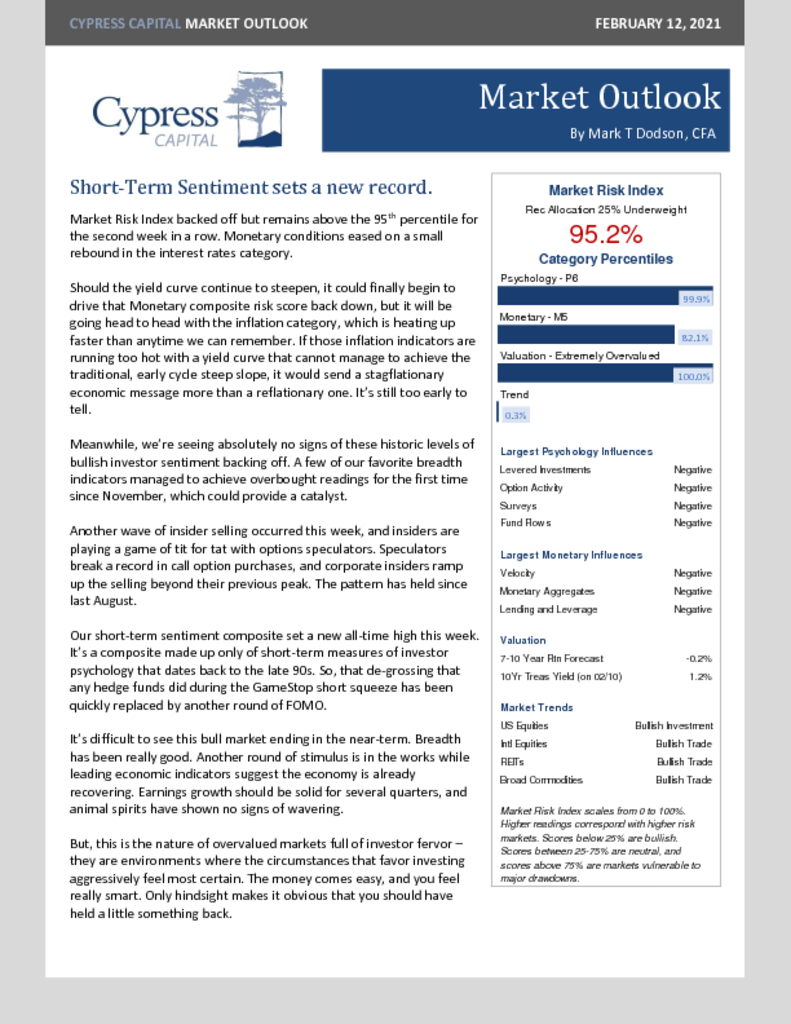

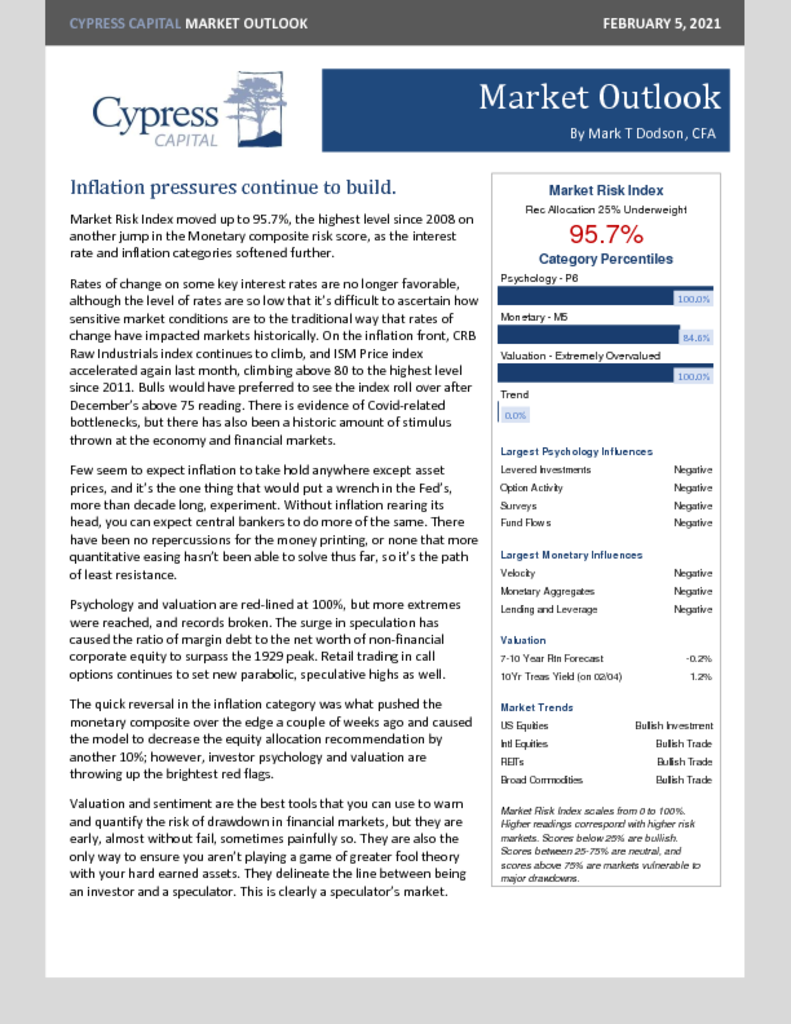

– Market Risk Index climbs to the highest level since 2008.

– Monetary conditions soften on inflation pressures.

– ISM Price Index hits the highest level since 2011.

– Margin Debt to Corporate Net Worth bests the 1929 peak.

%

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)