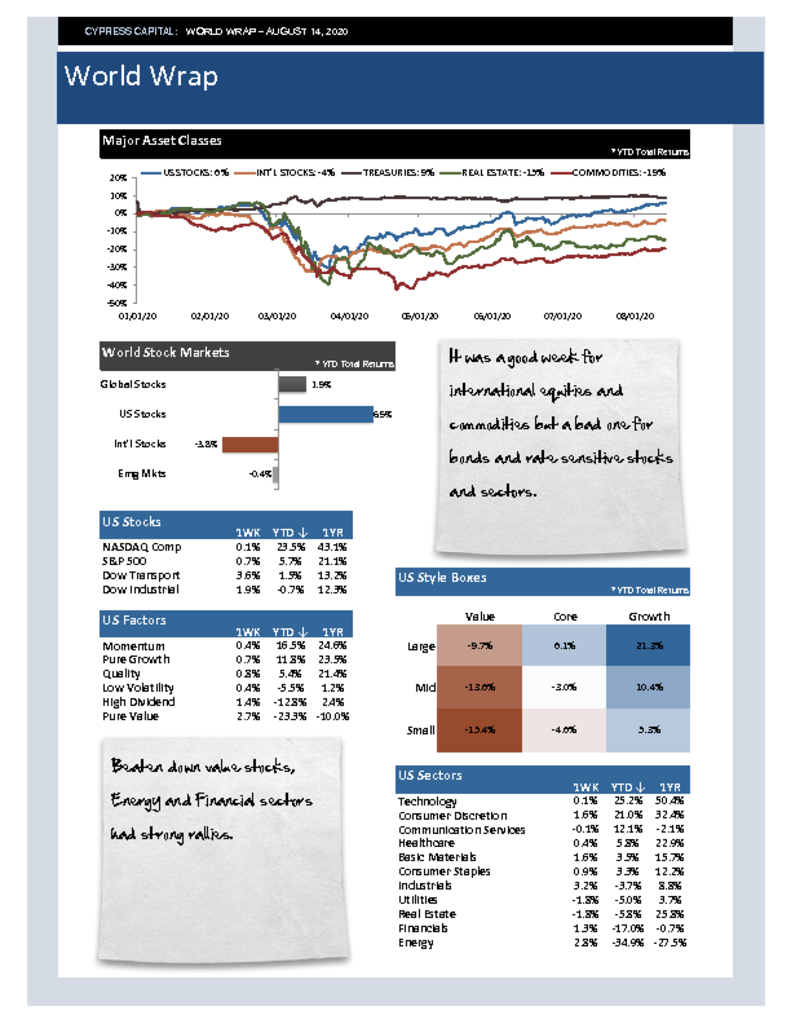

– It was a good week for international equities and commodities but a bad one for bonds and rate sensitive stocks and sectors.

– Beaten down value stocks, Energy and Financial sectors had strong rallies.

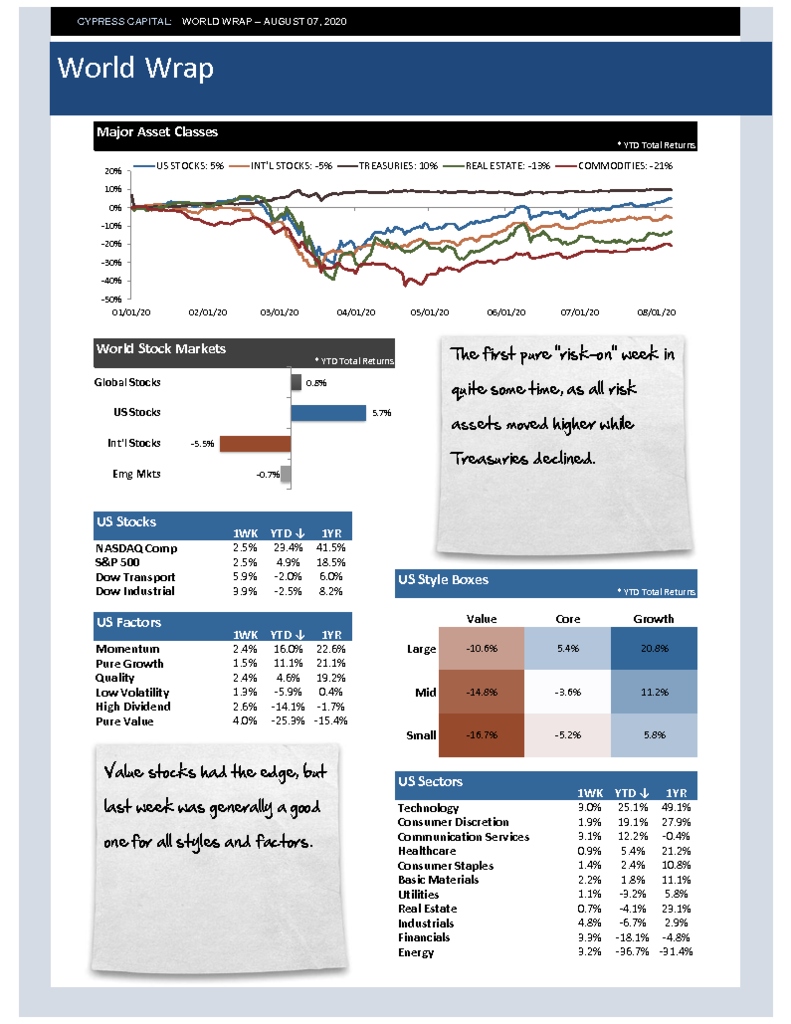

– Like the US, the international rally broadened last week with several of the lagging countries seeing a sizeable bounce.

– Lumber prices jumped another 12% last week – they have doubled over the last year.