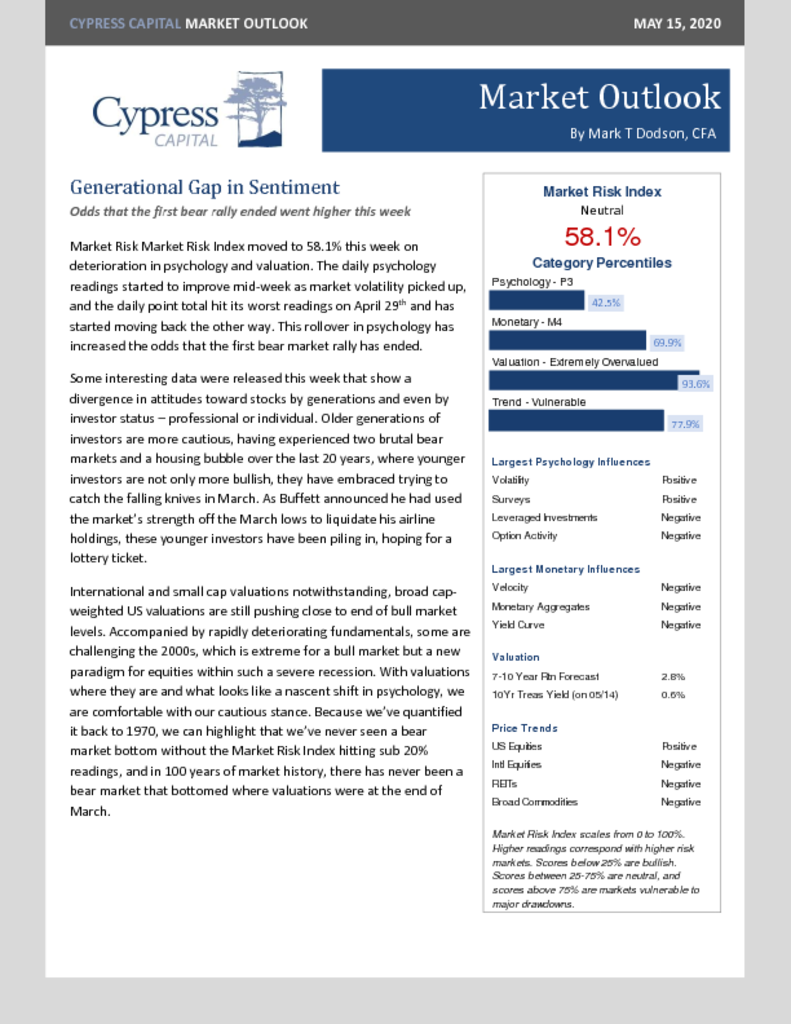

– Market Risk Index rises on deterioration in psychology and valuation

– Daily psychology readings have rolled over, increasing the odds that the first bear market rally has ended.

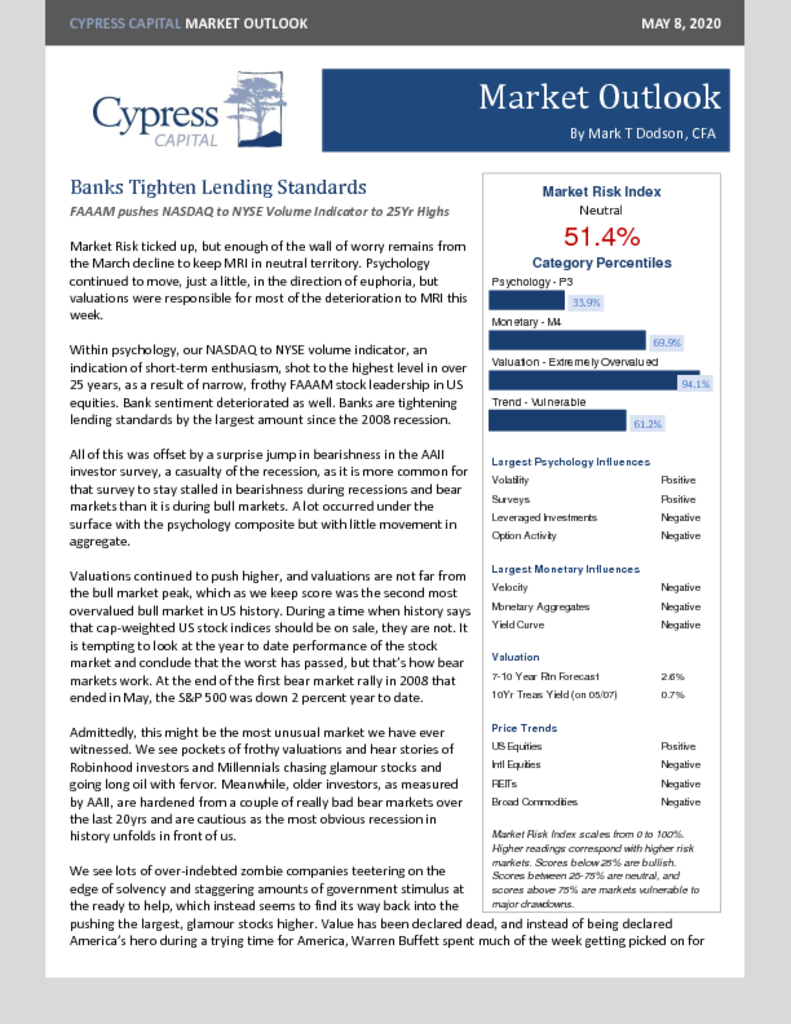

– Boomers are bearish, and Millennials are bullish.

– Valuations are pushing a new paradigm within such a severe recession.

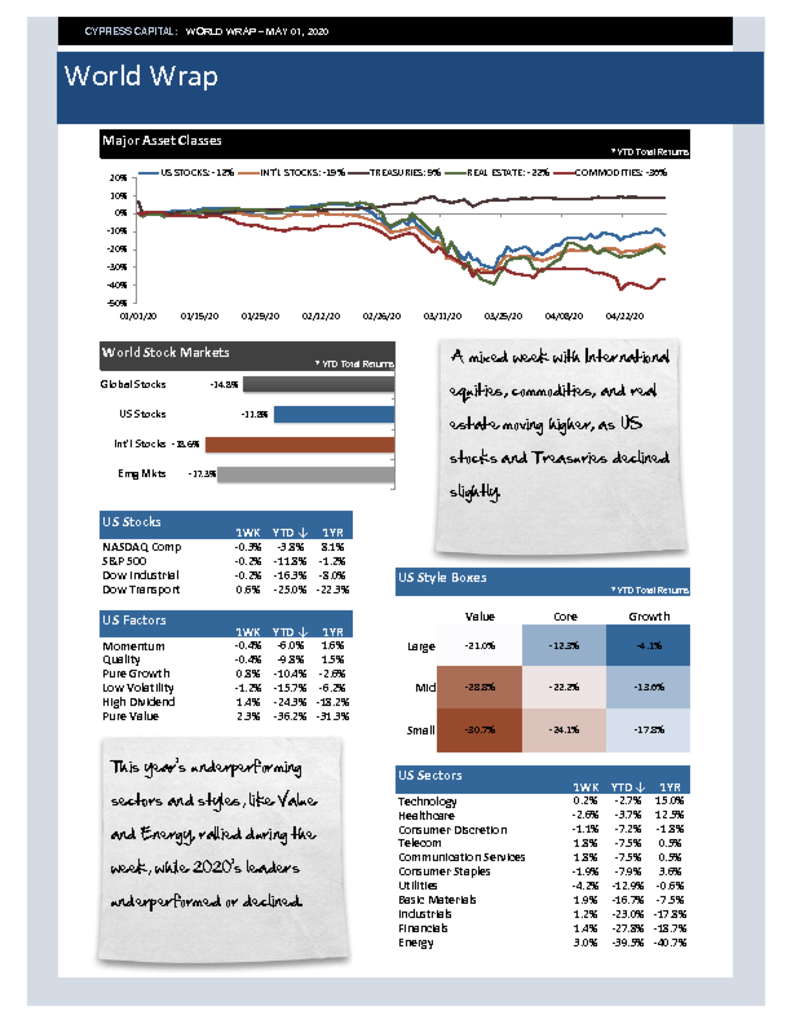

– Really unusual speculative sentiment and performance divergences are occurring within the recession.