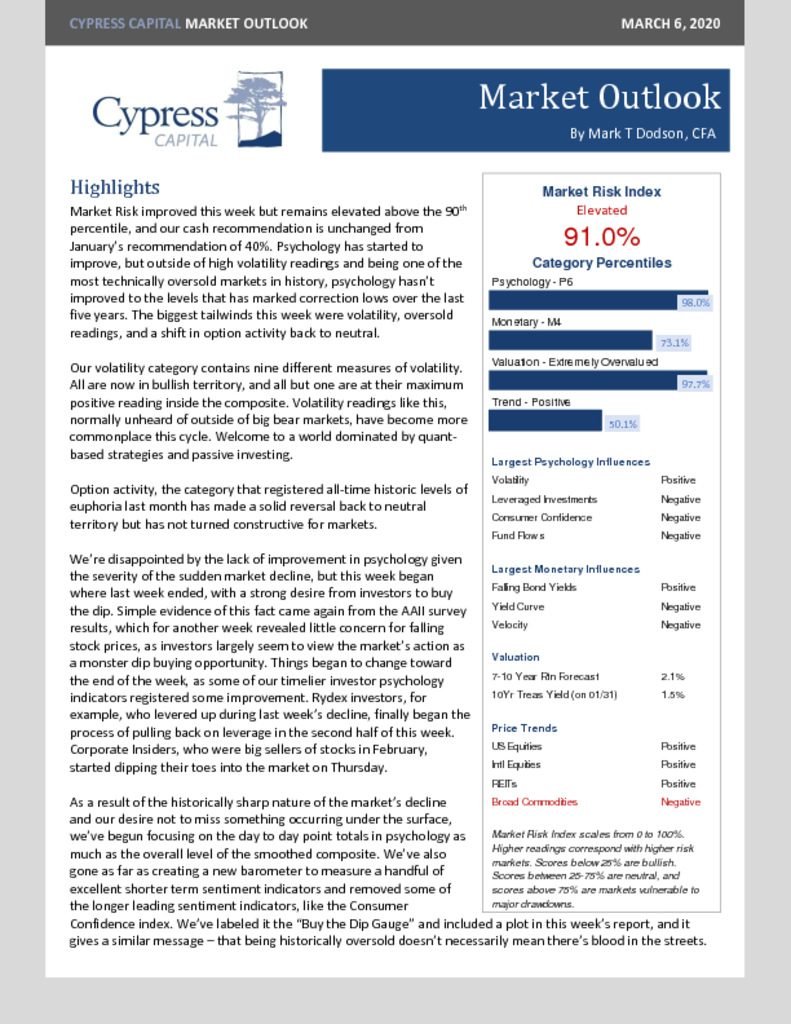

– Market Risk improves but still in the 90th percentile.

– Volatility and oversold levels are about as about as good as it gets, but investors are still not as nervous overall as they have been at previous correction lows this cycle.

– Measuring animal spirits is more important that divining bear market or correction catalysts.

– Buy the Dip Gauge indicates the level of pessimism isn’t extreme given the market’s sharp decline.