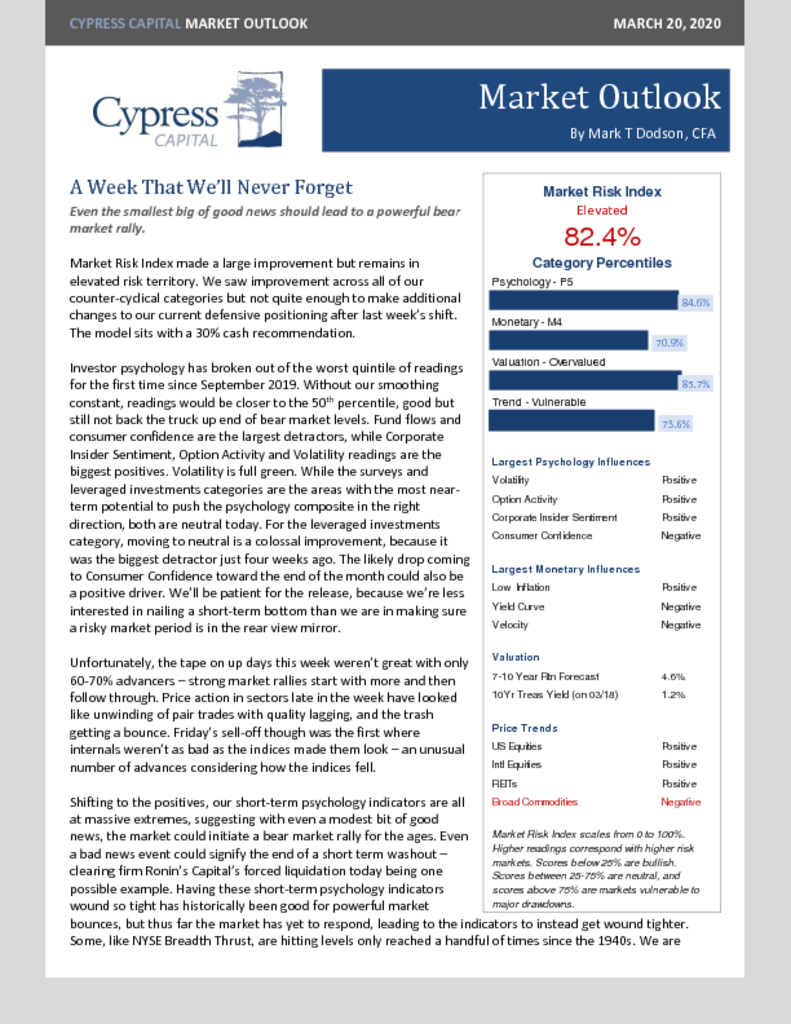

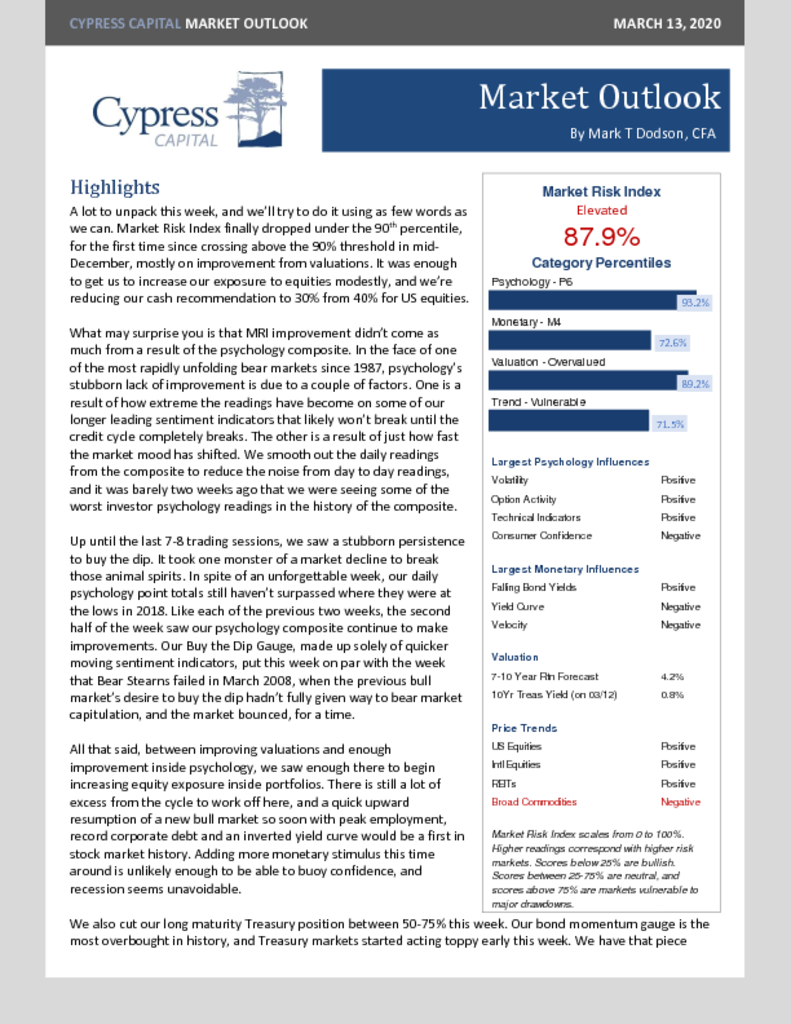

– Market Risk Index makes a big improvement, but still in elevated territory.

– Missing ingredients for the psychology composite – Surveys. Investors and gurus have been stubborn to give up on the bull market and let their narrative die.

– Short-term psychology is as wound up like we won’t see for another decade. If history is still useful, it suggests short-term capitulation is right around the corner.

– Small-cap valuations – best in a decade.

– A road map for the bear market.