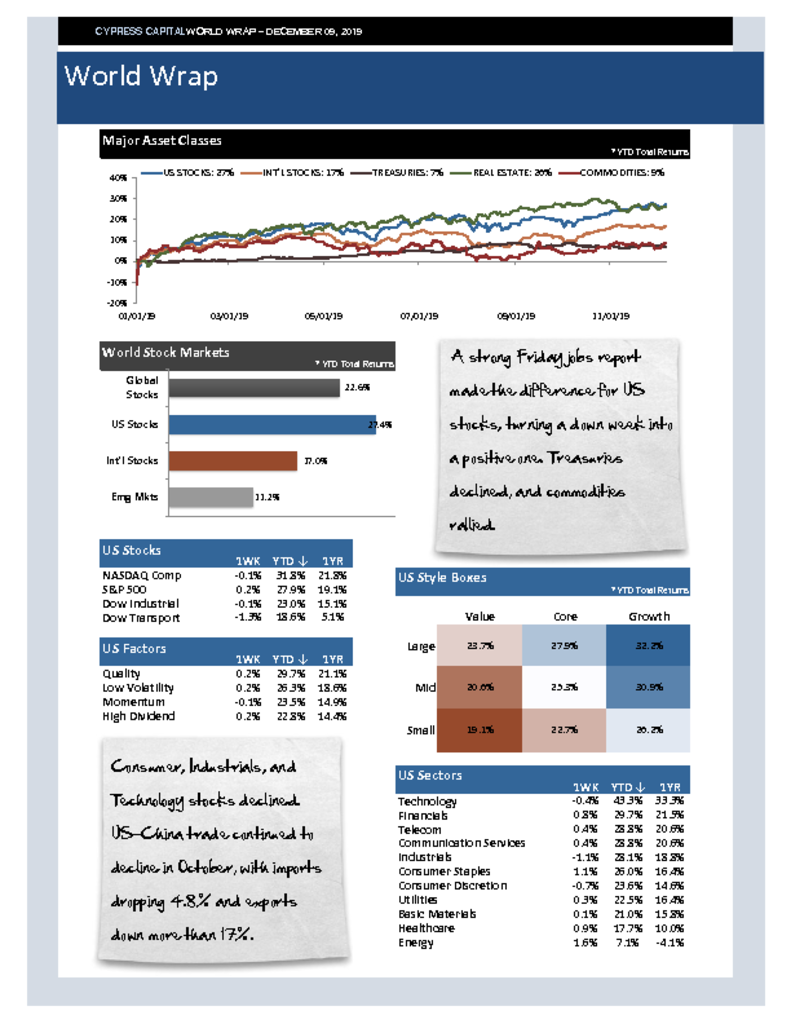

– Last week was good for almost all risk assets, except REITS, which closed down sharply by more than 3%.

– Almost every sector, style, and factor advanced last week. Small & Mid-Cap Growth and low volatility stocks bucked the trend and declined.

– China’s industrial output growth beat expectations in November, while IHS Markit’s preliminary December data shows Eurozone’s manufacturing recession is worsening.

– PIMCO, State Street, and Blackrock believe bonds aren’t pricing in a likely shift coming at the Fed to let inflation run hotter, making TIPS attractive.