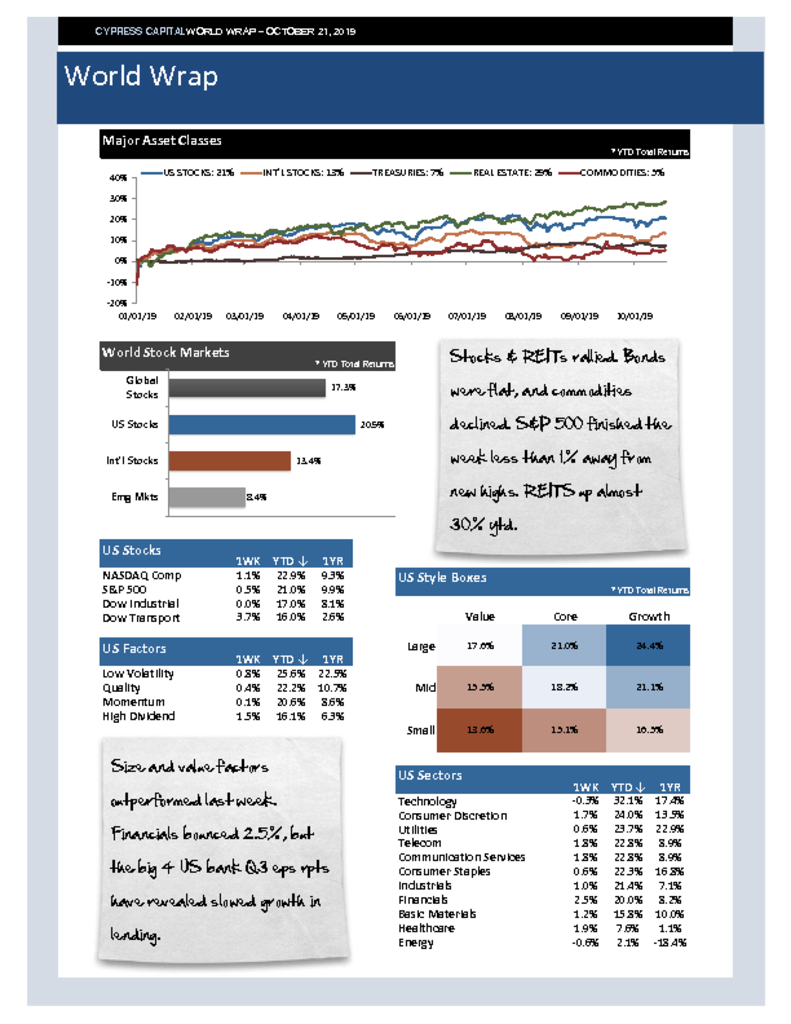

– Stocks & commodities moved higher – bonds & REITs lower. We plot the MSCI USA Index total return for US stocks, and the index reached a new high on Friday.

– Big bounce from Transports, Industrials, Energy and Finance. S&P 500 less than an 0.2% move from a new high.

– While not close to all-time highs, four countries finished the week at 52 week highs – France, Ireland, Japan and Russia.

– Fed widely expected to cut rates by 25bps on Wed. China’s state bank urged the country’s banks to step up application of “blockchain” and embrace “digital finance.”