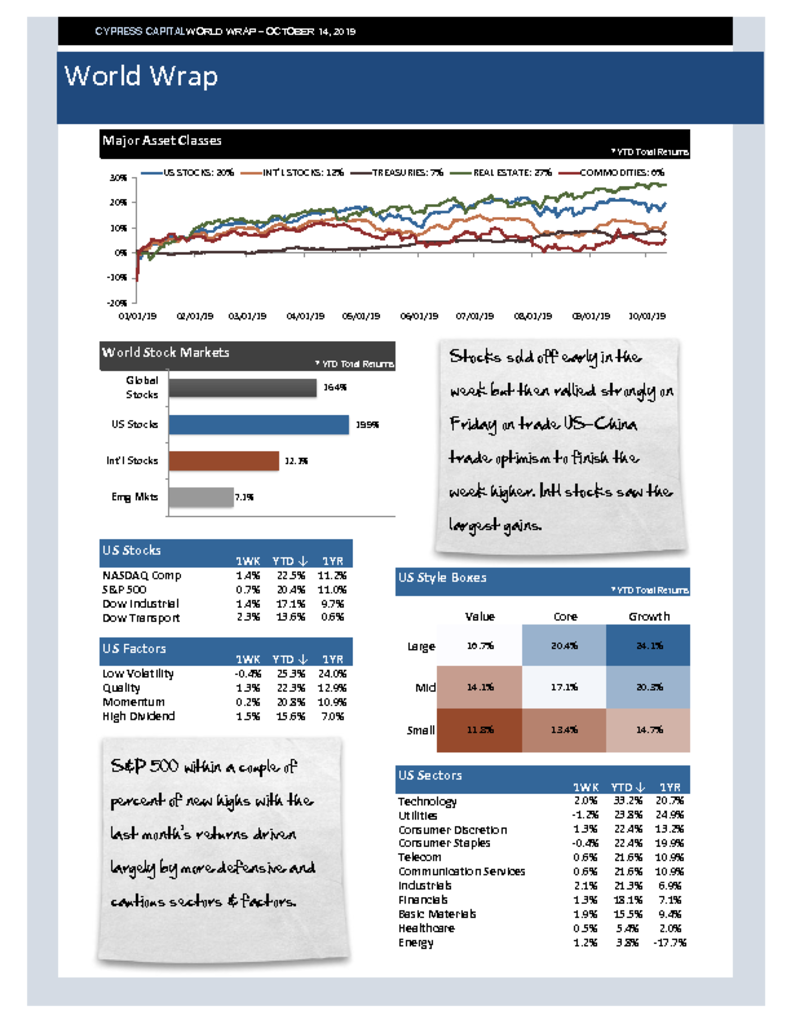

– Stocks sold off early in the week but then rallied strongly on Friday on trade US-China trade optimism to finish the week higher. Intl stocks saw the largest gains.

– S&P 500 within a couple of percent of new highs with the last month’s returns driven largely by more defensive and cautious sectors & factors.

– China exports to US dropped over 20% in September on heavier tariffs. Over weekend, China said to want more talks before agreeing to phase 1 deal.

– Fed announces it will buy $60 billion in T-Bills per month through Q2 2020 in an effort to stabilize money markets.