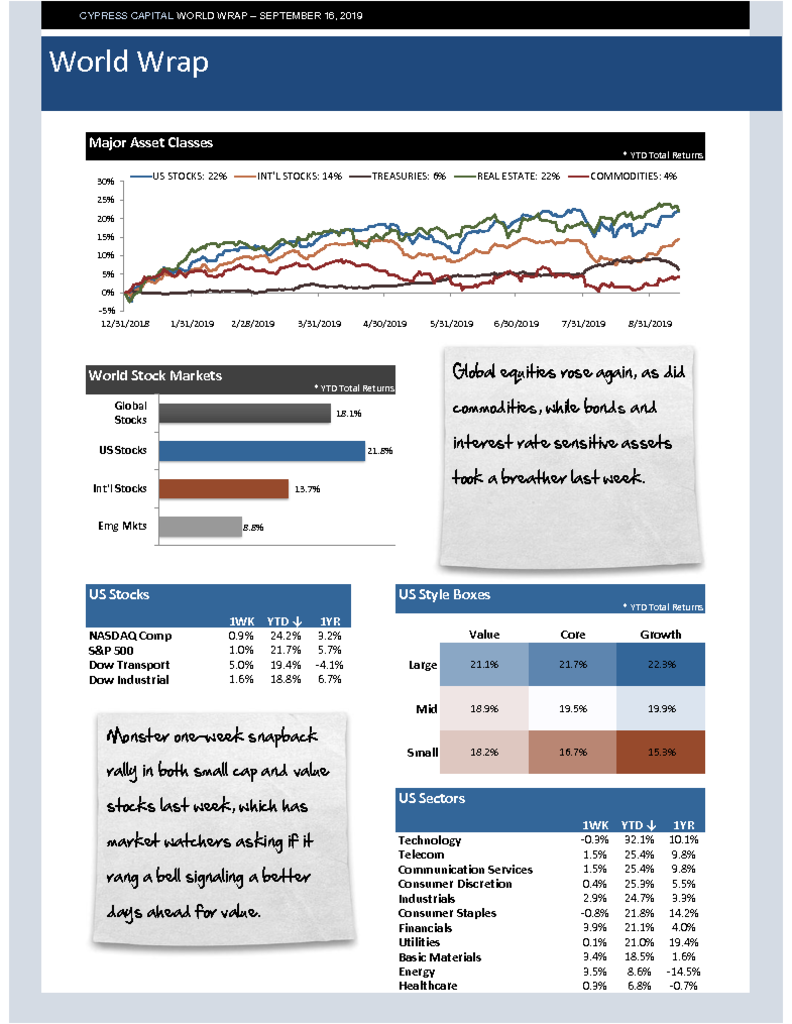

– Global equities rose again, as did commodities, while bonds and interest rate sensitive assets took a breather last week.

– Monster one-week snapback rally in both small cap and value stocks last week, which has market watchers asking if it rang a bell signaling a better days ahead for value.

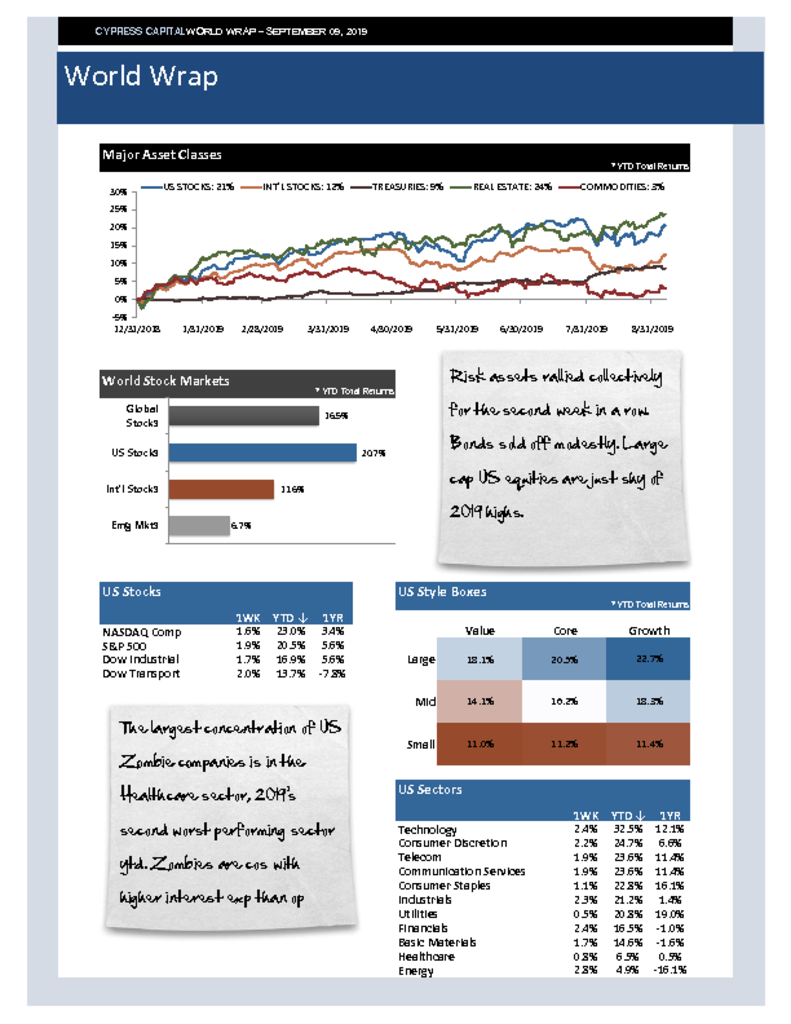

– Oil prices set to surge after drone attack on Saudi oil field takes out half the country’s oil production temporarily. China industrial production at 17-yr low.

– Fed is widely expected to cut rates by 25 basis points this week. WSJ reports warning signs coming from high yield market.