Psychology still showing excessive enthusiasm but out of bottom decile.

High Low Logic goes from minor sell signal to major one.

T-Bill yields acting like a Fed Funds rate cut is a given.

Psychology still showing excessive enthusiasm but out of bottom decile.

High Low Logic goes from minor sell signal to major one.

T-Bill yields acting like a Fed Funds rate cut is a given.

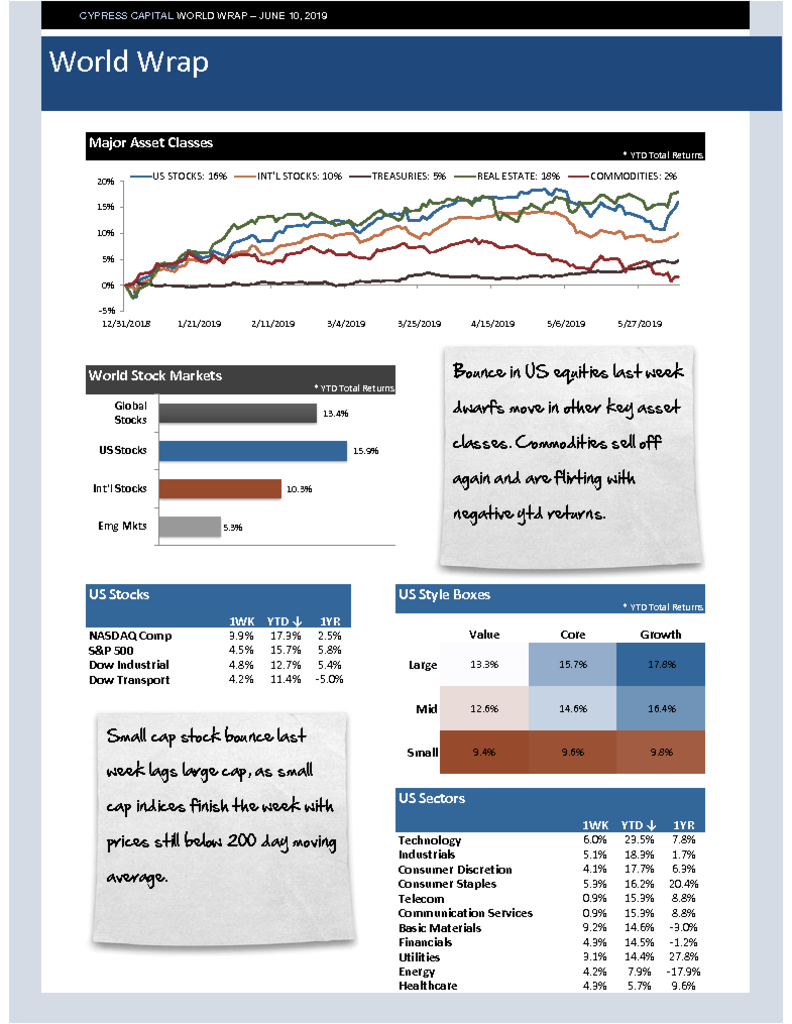

Bounce in US equities last week dwarfs move in other key asset classes. Commodities sell off again and are flirting with negative ytd returns.

Small cap stock bounce last week lags large cap, as small cap indices finish the week with prices still below 200 day moving average.

US suspended Mexico tariffs following deal on migration. WSJ reports that deal also “reinforces the notion that US will continue to use tariffs as leverage.”

The probability of a Fed rate cut next month shot above 80% after Friday’s weaker than expected payroll report. Stock market appears to be discounting rate cut as well.

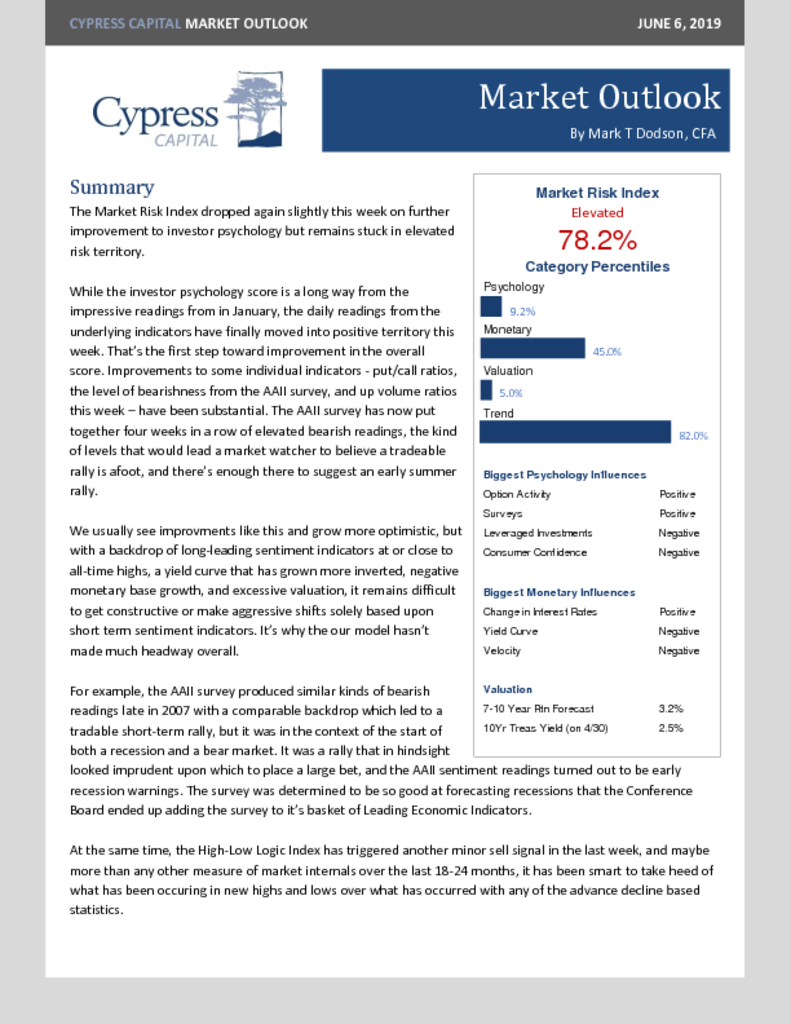

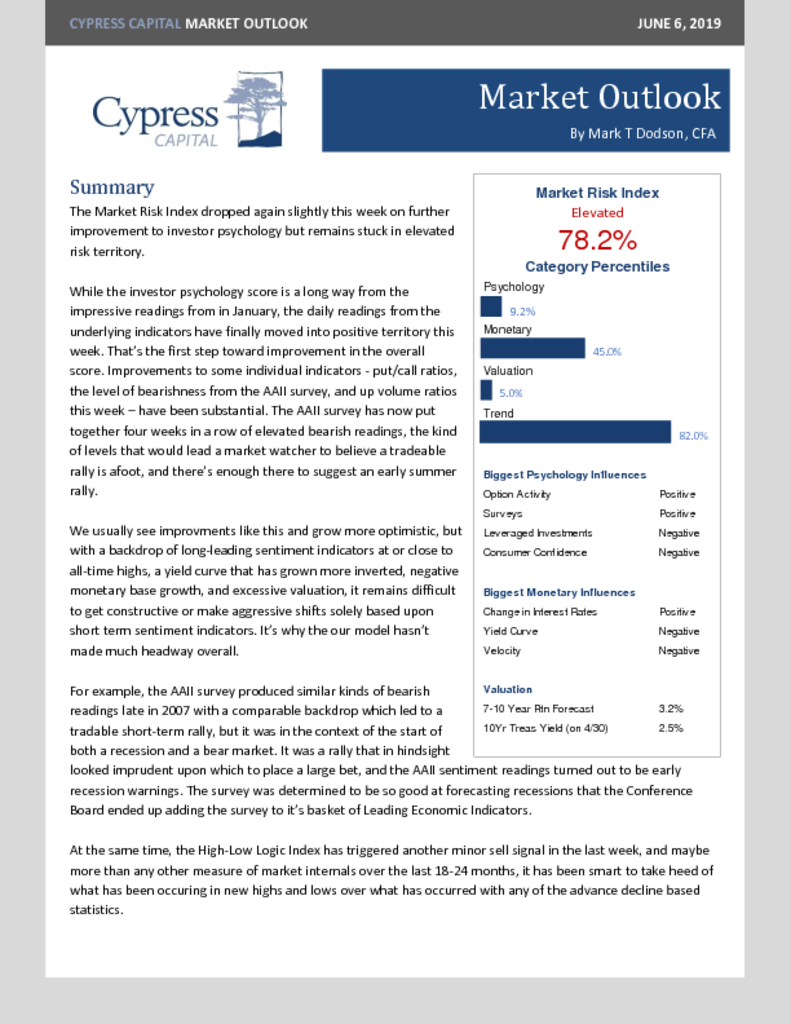

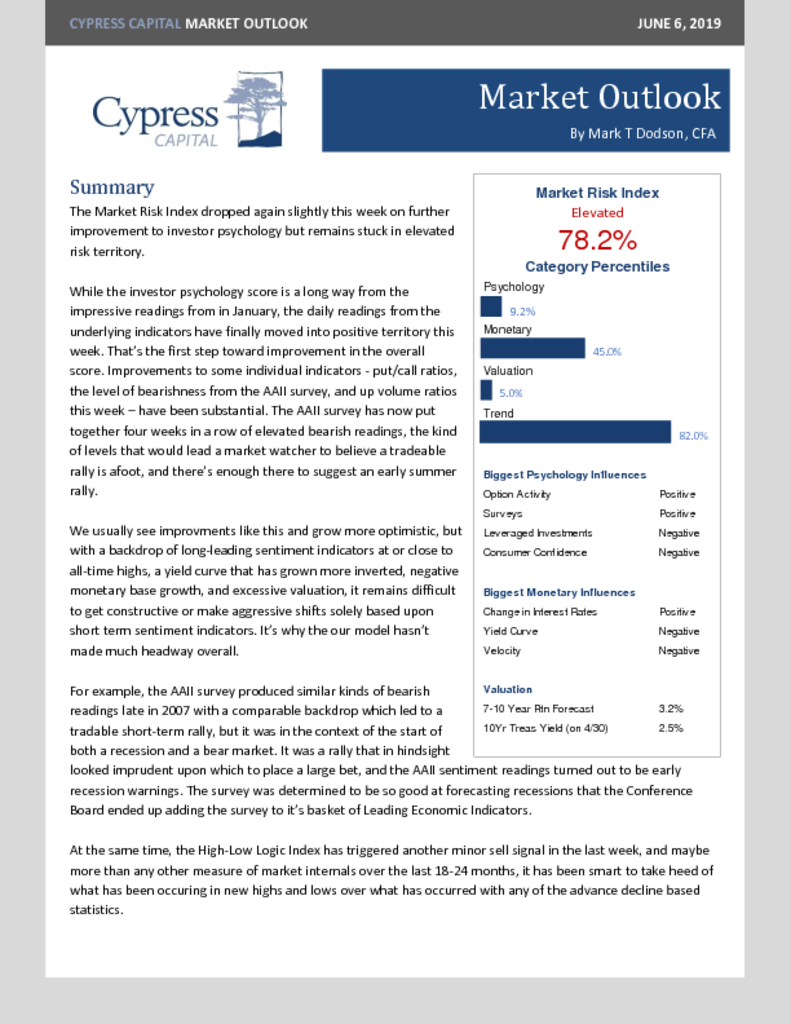

Market risk improves slightly.

AAII Survey produces four consecutive weeks of high bearish readings.

High Low Logic Index gives sell signal.

Yield curve moves firmly into inverted territory.

Tariffs have been largely offset by a falling Chinese currency.

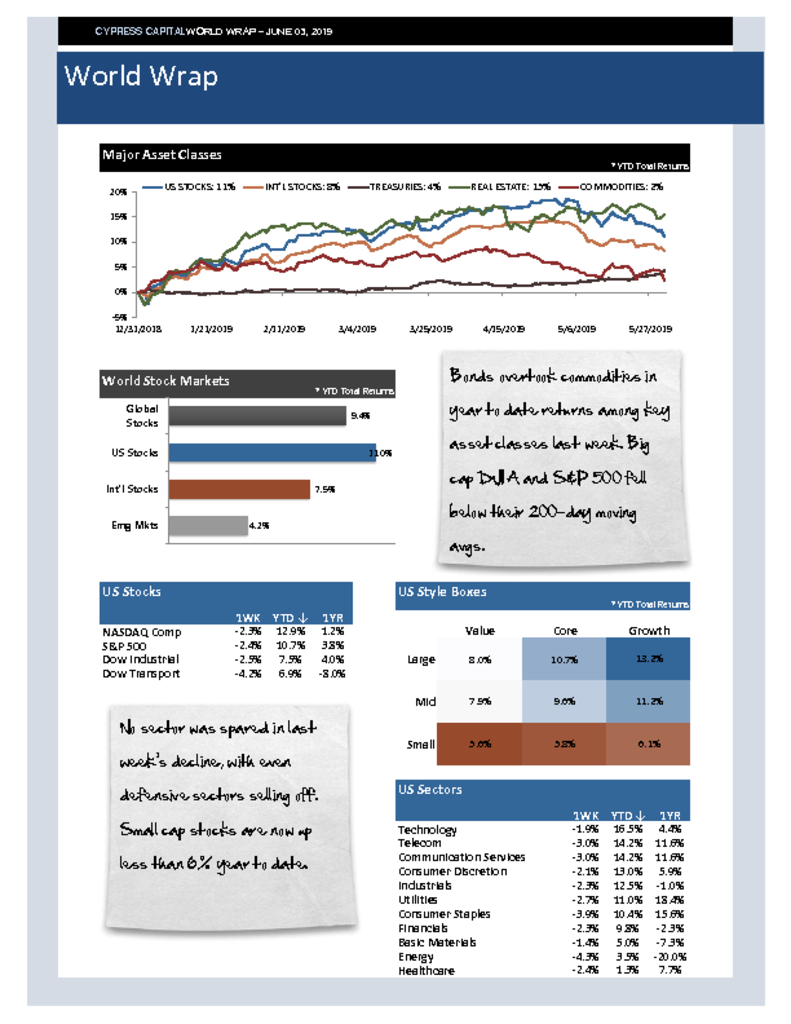

Bonds overtook commodities in year to date returns among key asset classes last week. Big cap DJIA and S&P 500 fell below their 200-day moving avgs.

No sector was spared in last week’s decline, with even defensive sectors selling off. Small cap stocks are now up less than 6% year to date.

WSJ reports over the weekend that China and Mexico have signaled “a willingness to step up trade talks with the US.”

Fed conference in Chicago this week to focus on concerns about the economy falling into a low-inflation trap like Japan.

%

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)