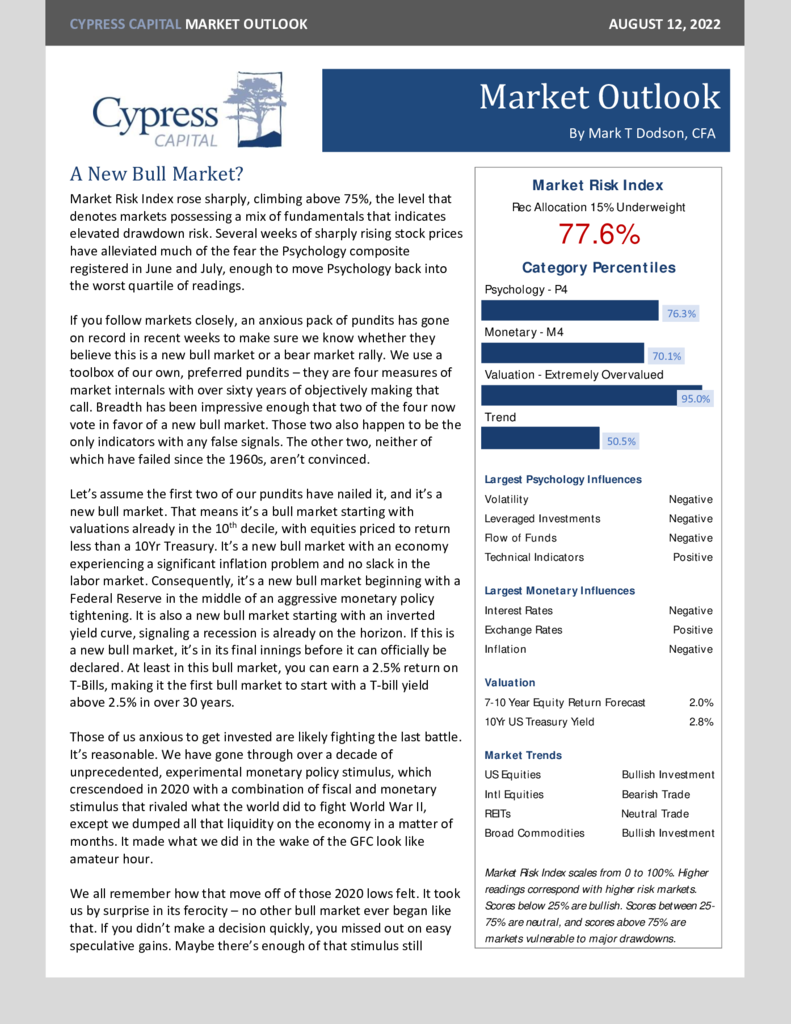

– Global stocks and commodities rallied. US Treasuries declined modestly for the week.

– The rally was broad among styles and factors, but value edged out growth on a 7.5% one-week gain in Energy stocks

– Chinese equities declined during a week of widespread strength in global equities. The country’s stock market has been moving to the beat of a different drum all year.

– Commodity prices snapped back. Lumber prices climbed 19% in a single week.