Archive

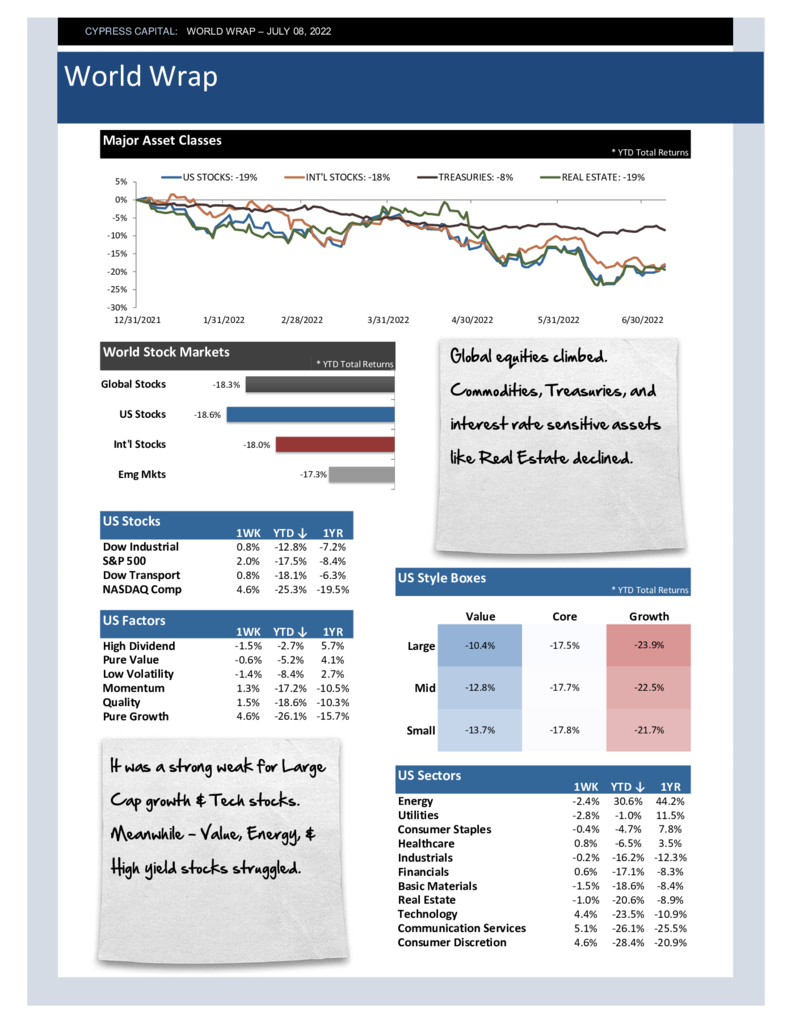

World Wrap

– Global equities climbed. Commodities, Treasuries, and interest rate sensitive assets like Real Estate declined.

– It was a strong weak for Large Cap growth & Tech stocks. Meanwhile – Value, Energy, & High yield stocks struggled.

– International equities advanced, but it wasn’t a broad move. Twenty-one of the 45 countries we track declined week over week.

– The US Dollar jumped 1.8% and is now up 11.5% year to date.

Market Outlook – Stagflation is official, according to ISM

Q2 2022 World Wrap

– Global equities and fixed income declined in the second quarter. Commodities moved higher by 2% on the strength of crude oil.

– All sectors styles and factors declined in the second quarter. Energy was strong up until June, when the sector crashed by more than 22%.

– China shrugged off global market weakness and advanced more than 3% during the quarter. It was one of only two countries to see higher stock prices in Q2.

– Crude oil rallied 10% during the quarter – the Dollar was up 6.5% – and Bitcoin plunged by nearly 60%.

%

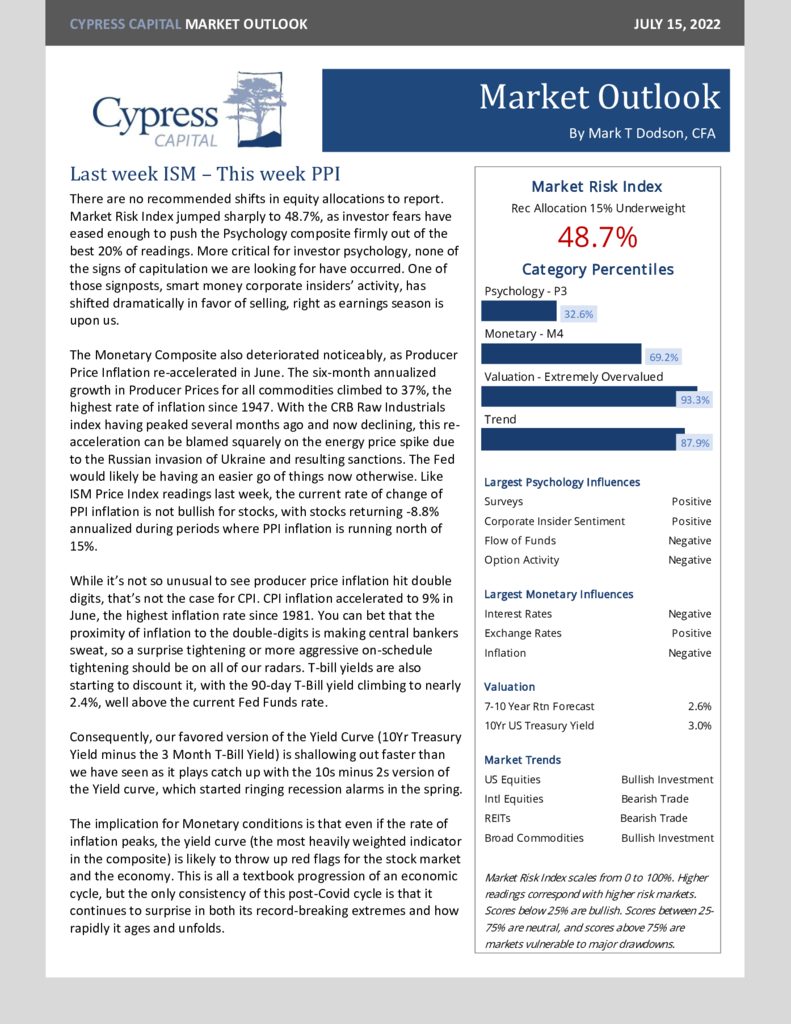

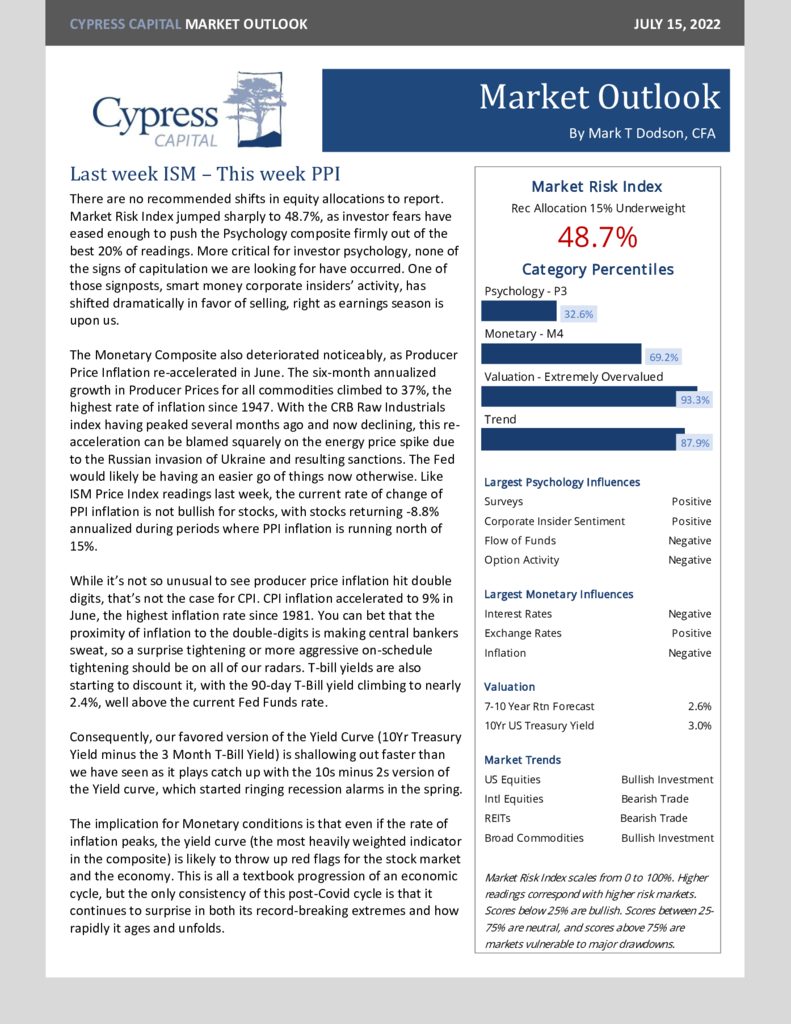

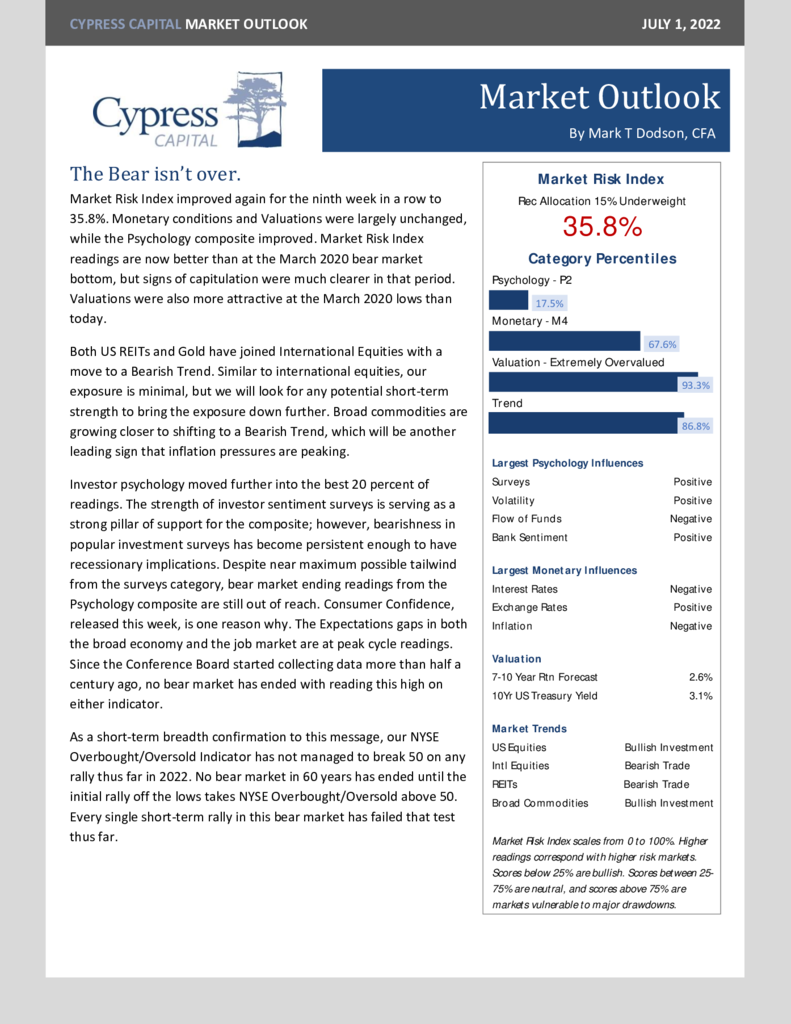

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%