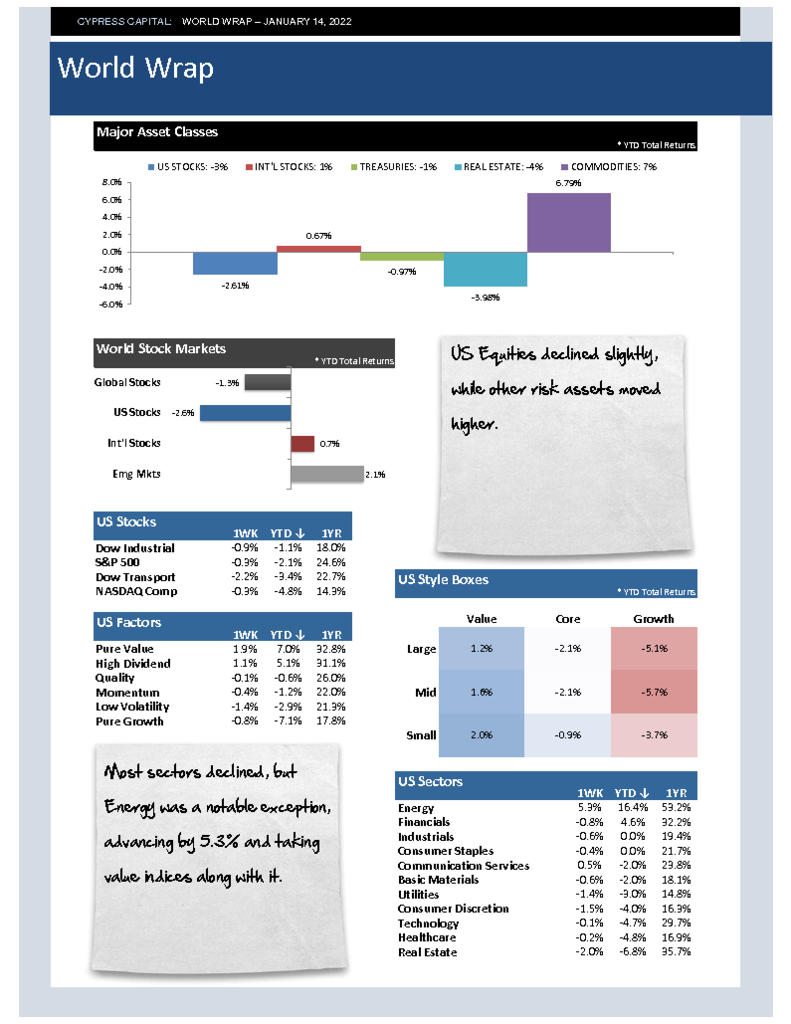

– US Equities declined slightly, while other risk assets moved higher.

– Most sectors declined, but Energy was a notable exception, advancing by 5.3% and taking value indices along with it.

– It was a big week for Emerging market stocks – up more than 2.6% – bringing their ytd return up to 2.1%.

– Broad advance for commodities – crude oil prices are up nearly 12% in the first two weeks of January.