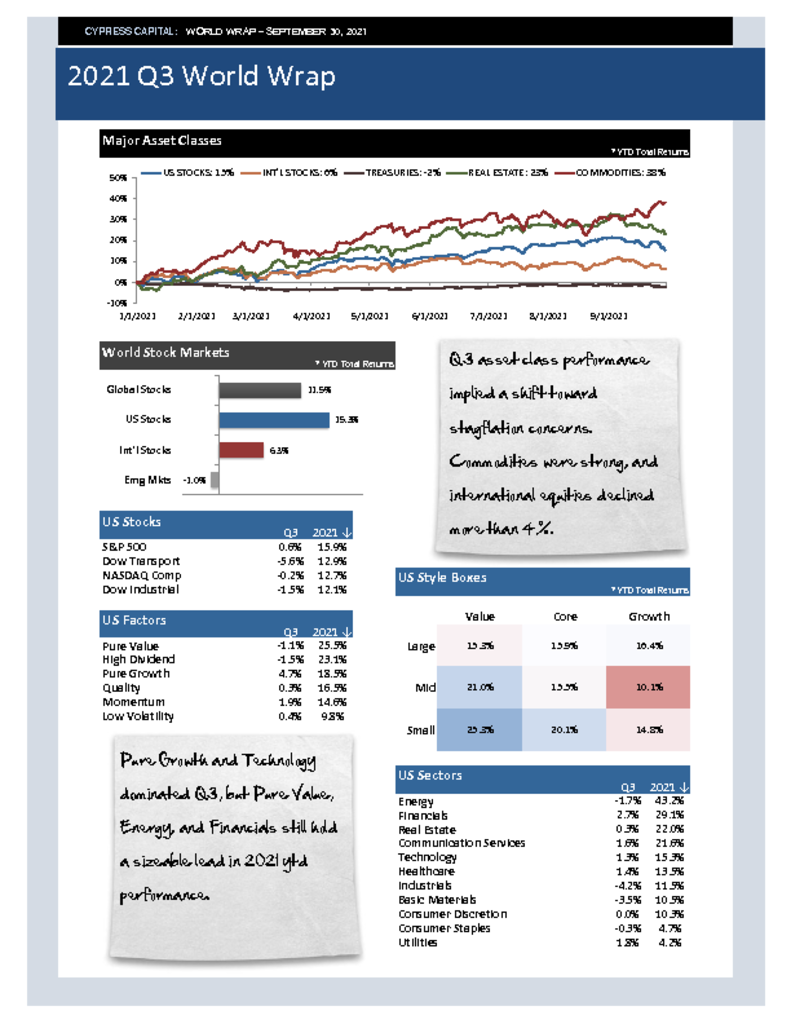

– Q3 asset class performance implied a shift toward stagflation concerns. Commodities were strong, and international equities declined more than 4%.

– Pure Growth and Technology dominated Q3, but Pure Value, Energy, and Financials still hold a sizeable lead in 2021 ytd performance.

– Emerging markets continued to soften, declining 8% for the quarter and closing in negative territory ytd. Concerns about credit and leverage in China linger.

– Lumber passed the baton to Natural Gas, which had a monster 59.6% return in Q3, while Lumber declined 14.8%.