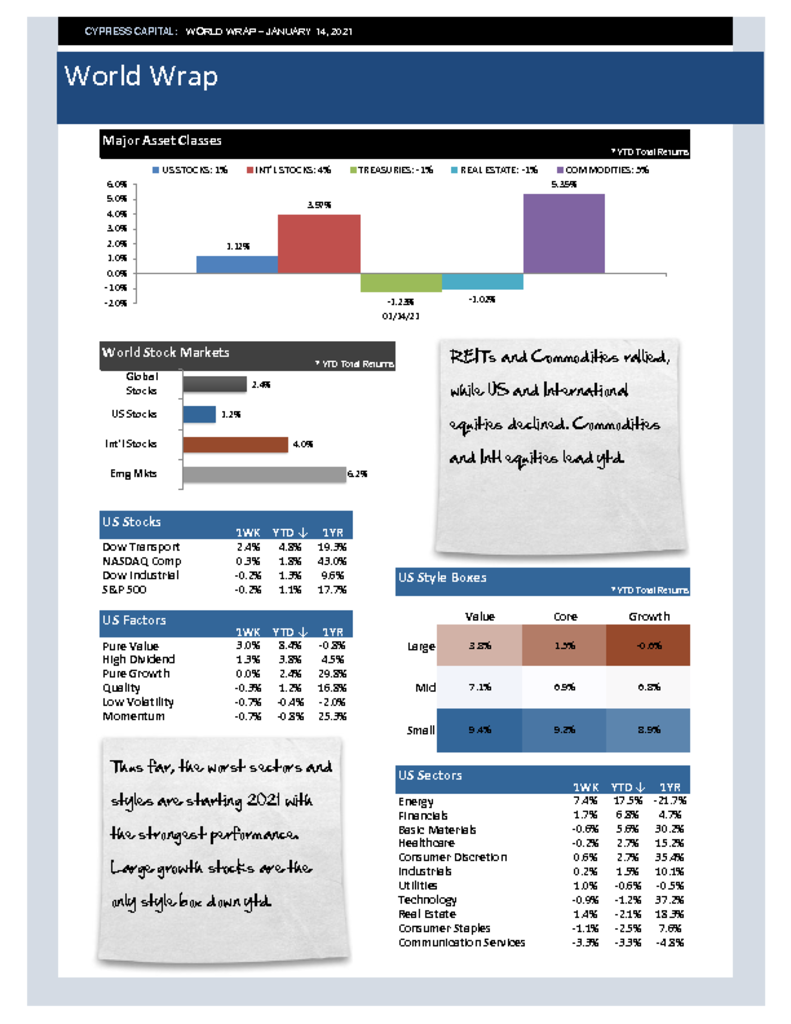

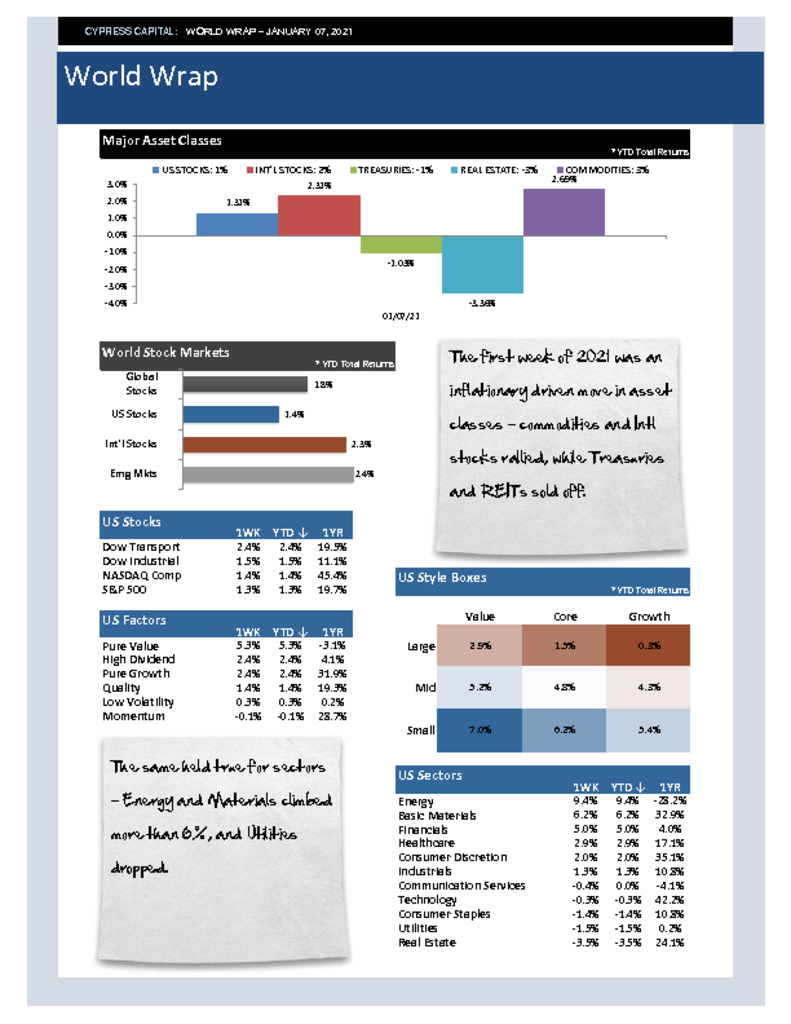

– REITs and Commodities rallied, while US and International equities declined. Commodities and Intl equities lead ytd.

– Thus far, the worst sectors and styles are starting 2021 with the strongest performance. Large growth stocks are the only style box down ytd.

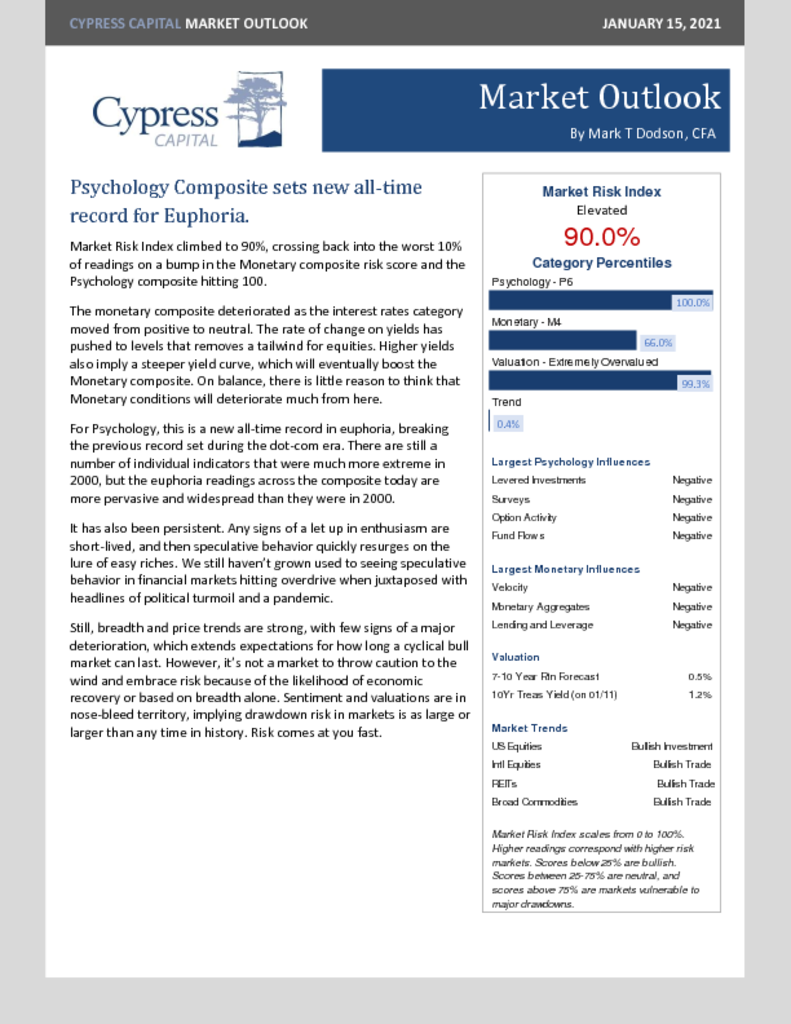

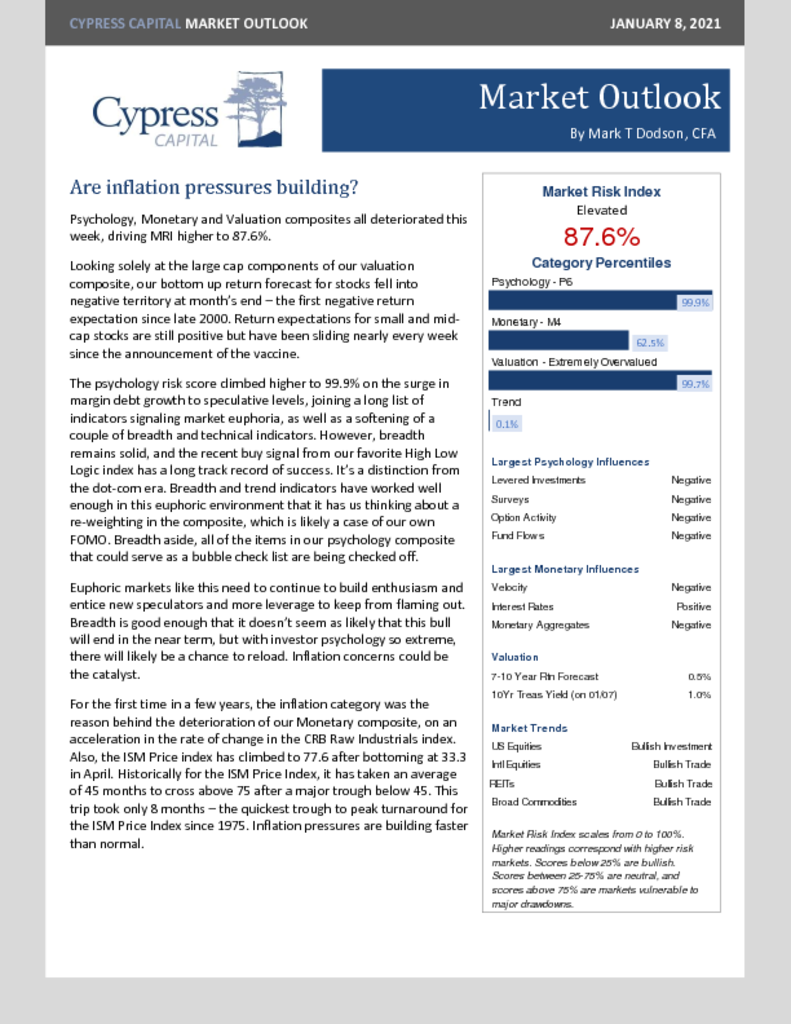

– Emerging markets have had a strong start to 2021, and speculation in call options has spread to emerging market ETFs.

– Crude oil is up more than 10% ytd, driving broad commodity indices higher. Treasury yields continue to climb.