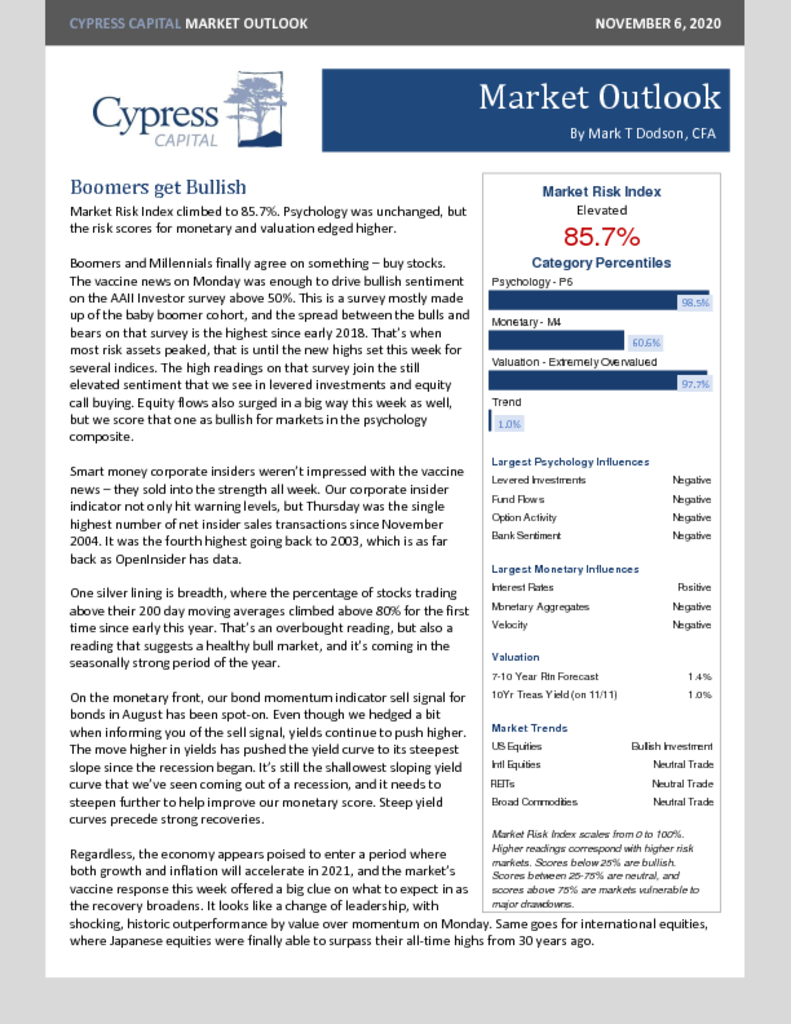

– Boomers and Millennials finally agree on something – buy stocks.

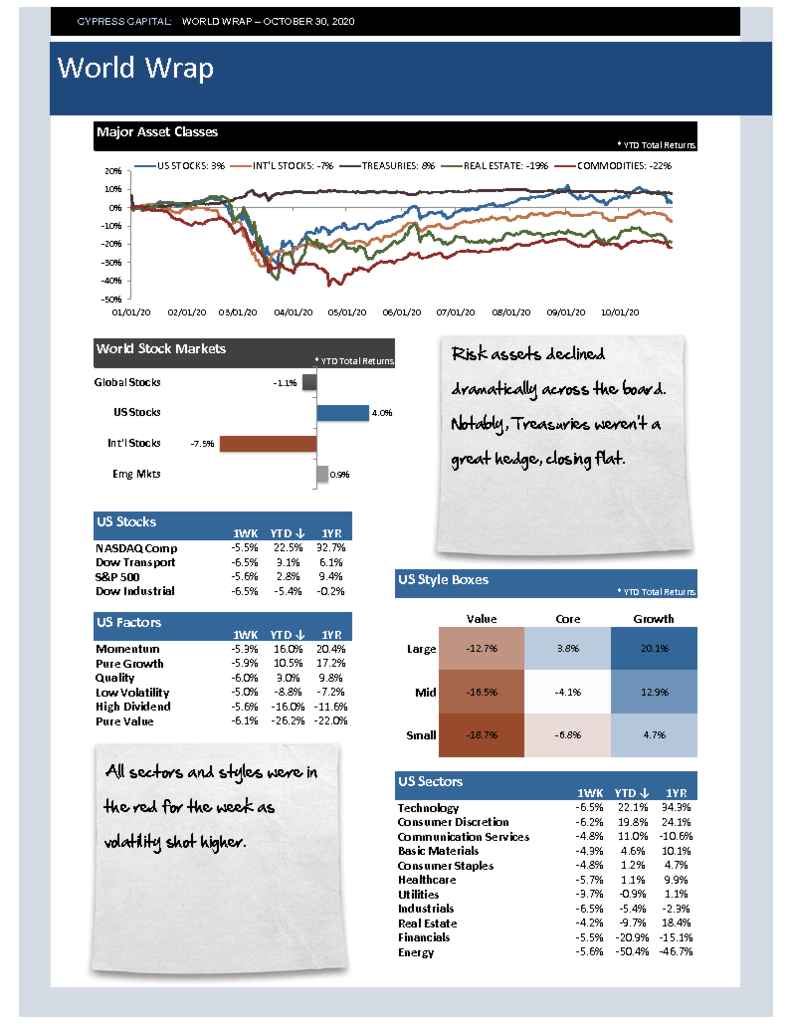

– Thursday was the single highest number of net insider sales transactions since November 2004.

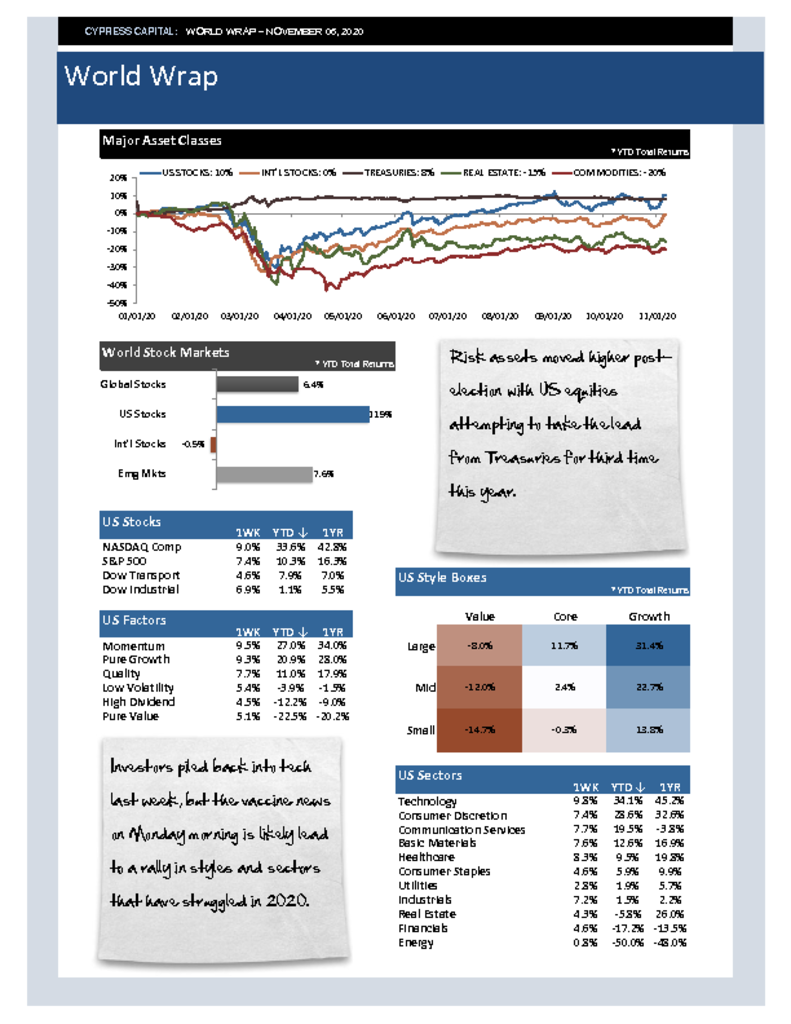

– Breadth hits a key bull market threshold.

– Historic one day shift in value versus momentum on vaccine day, suggesting a change in leadership is coming.