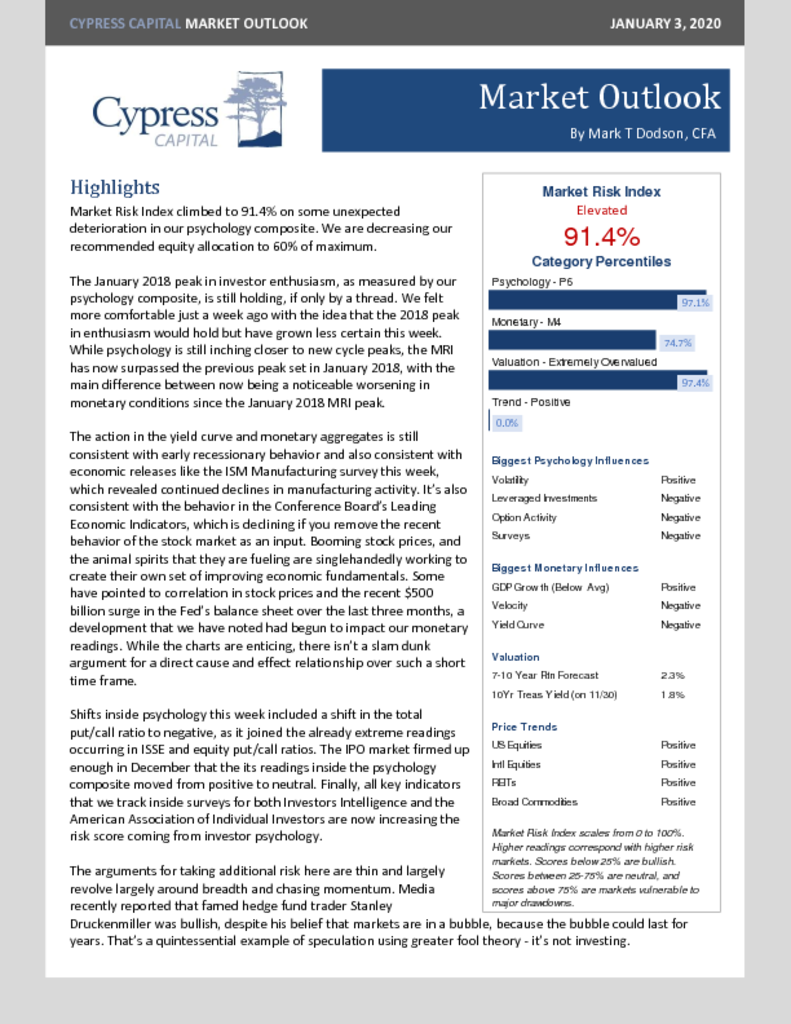

– Market Risk Index climbs to 91.4%, surpassing Jan 2018 peak. Reducing equity allocation recommendation to 60% of maximum.

– Psychology deteriorates further – AAII bullishness breaks out to highest levels since Jan 2018.

– ARMS Index hitting levels that have halted rallies over the last two years.

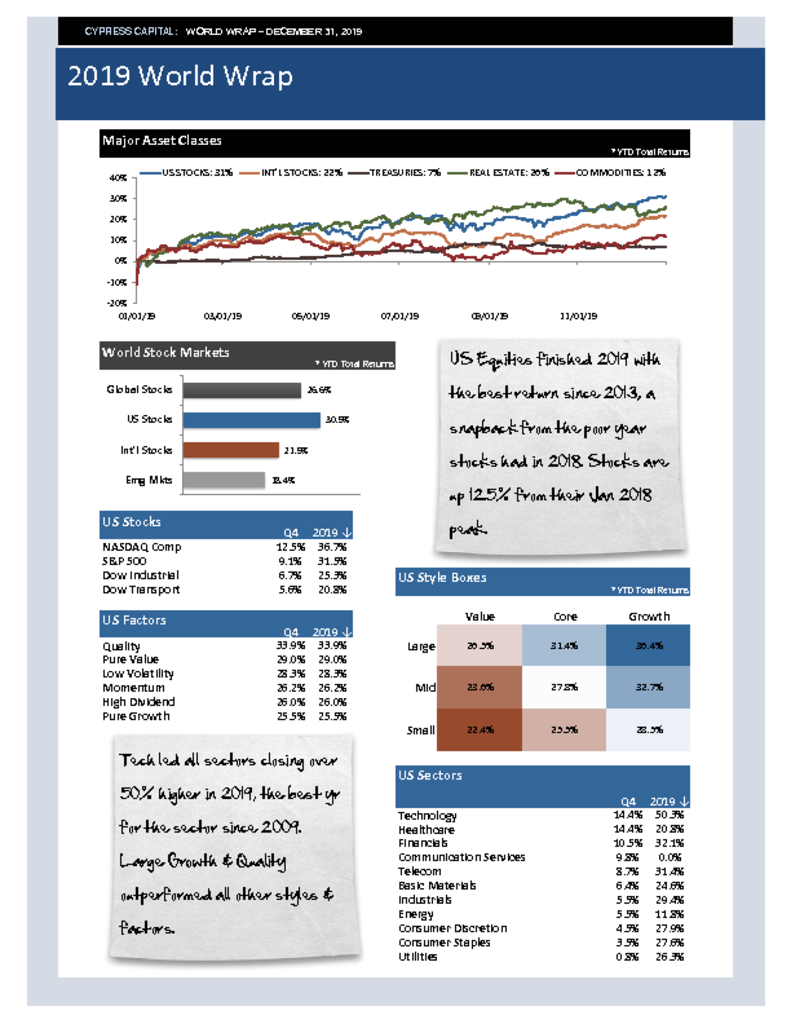

– …and lots of charts.