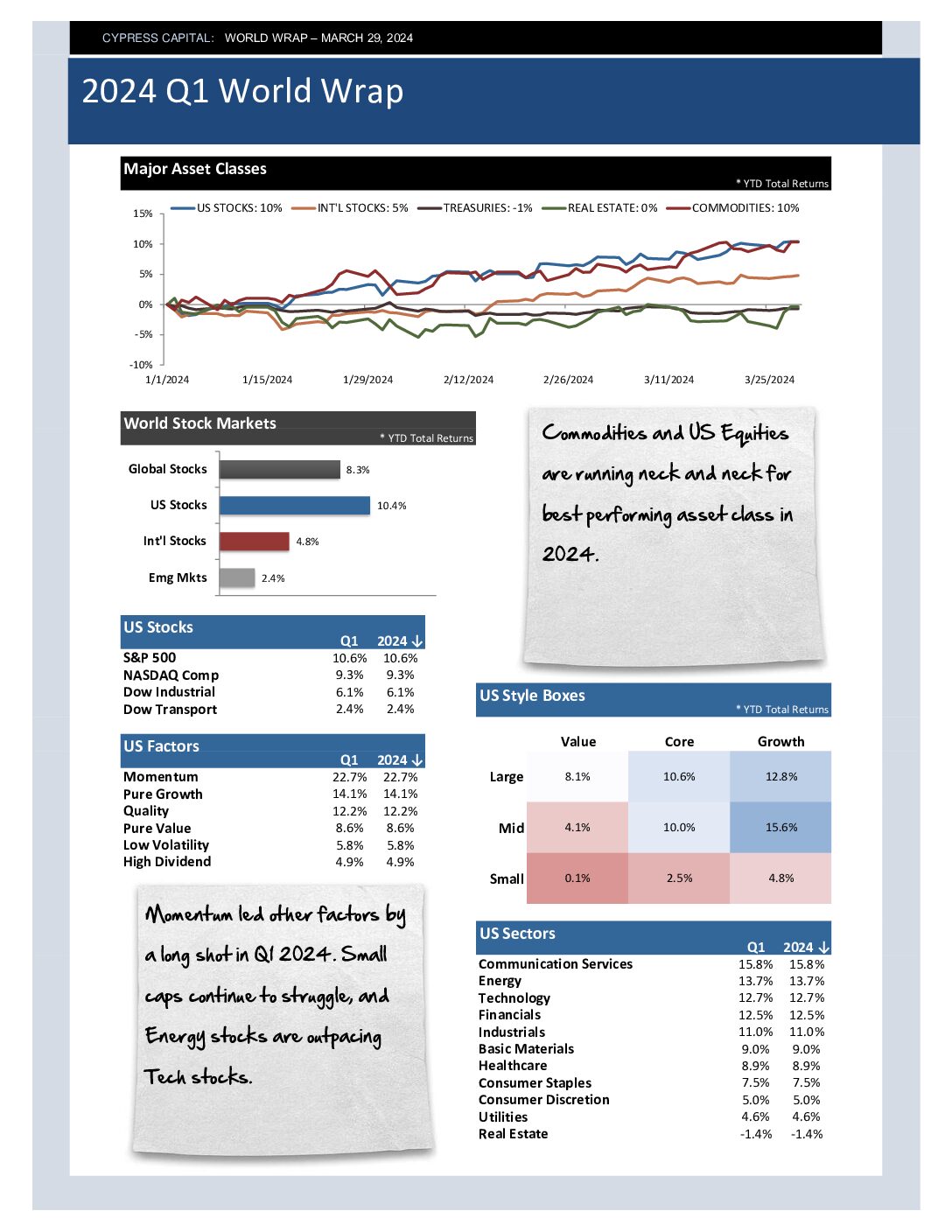

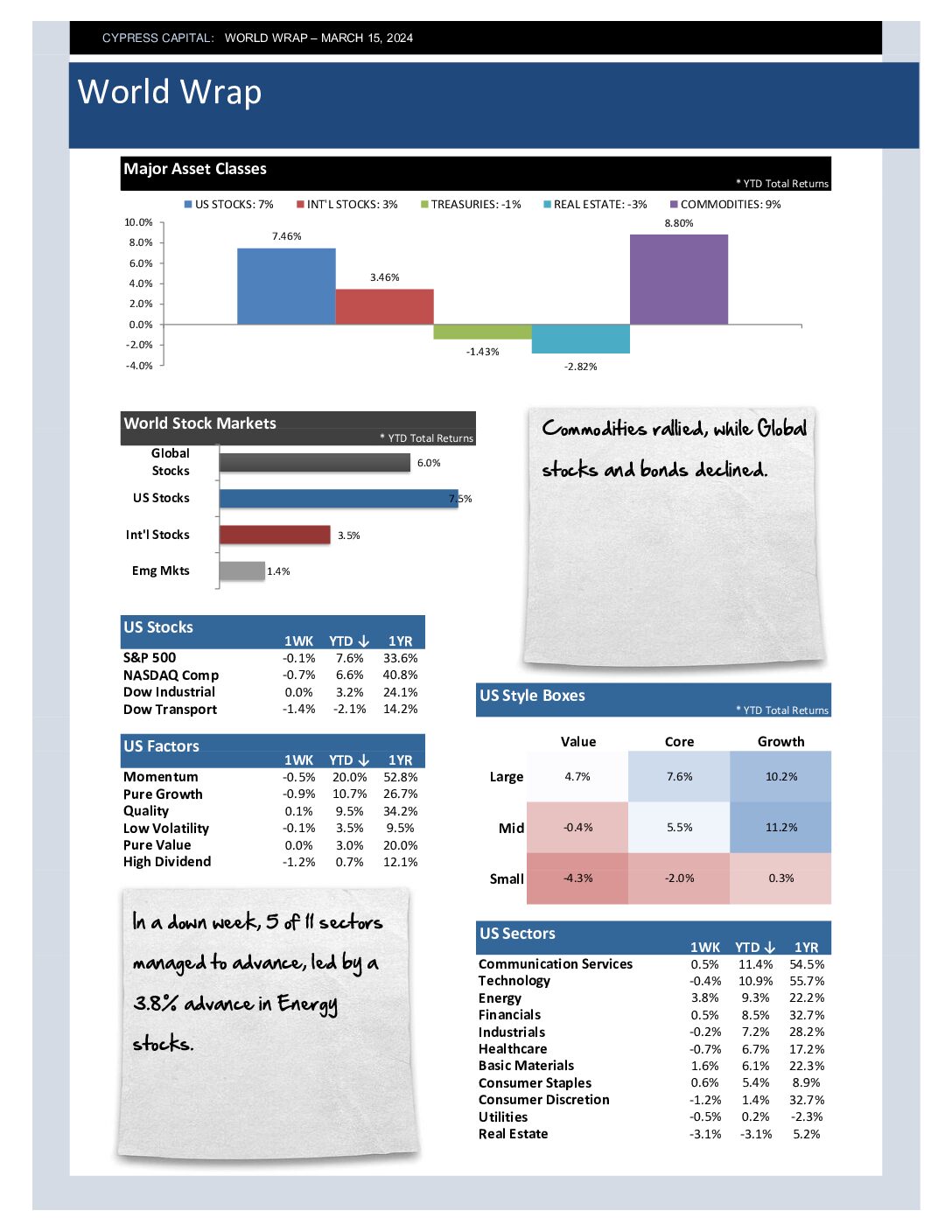

– Commodities and US Equities are running neck and neck for best performing asset class in 2024.

– Momentum led other factors by a long shot in Q1 2024. Small caps continue to struggle, and Energy stocks are outpacing Tech stocks.

– Intl equities are up, but lagging. China declined, but avoided a new low. Should China’s poor performance persist, it will be the 4th straight yr of declines.

– Mostly declines in global fixed income for the quarter. US High Yield and Treasury bills are the only two sectors with positive returns ytd.