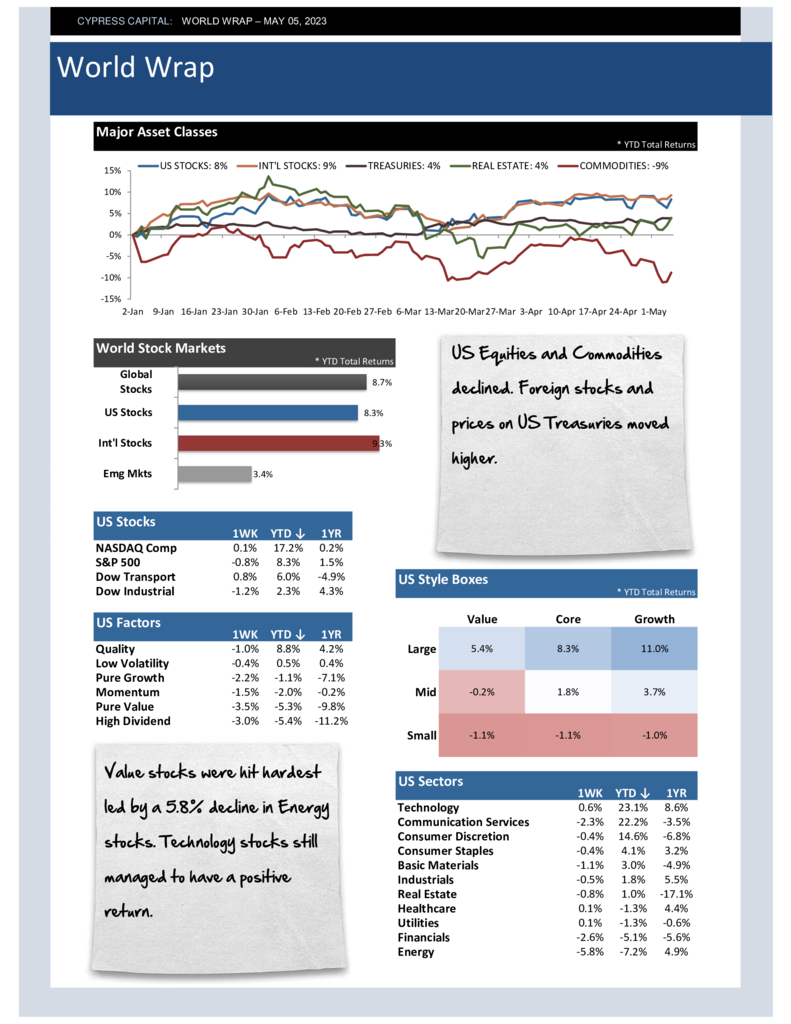

– While not severe, all major asset classes declined last week.

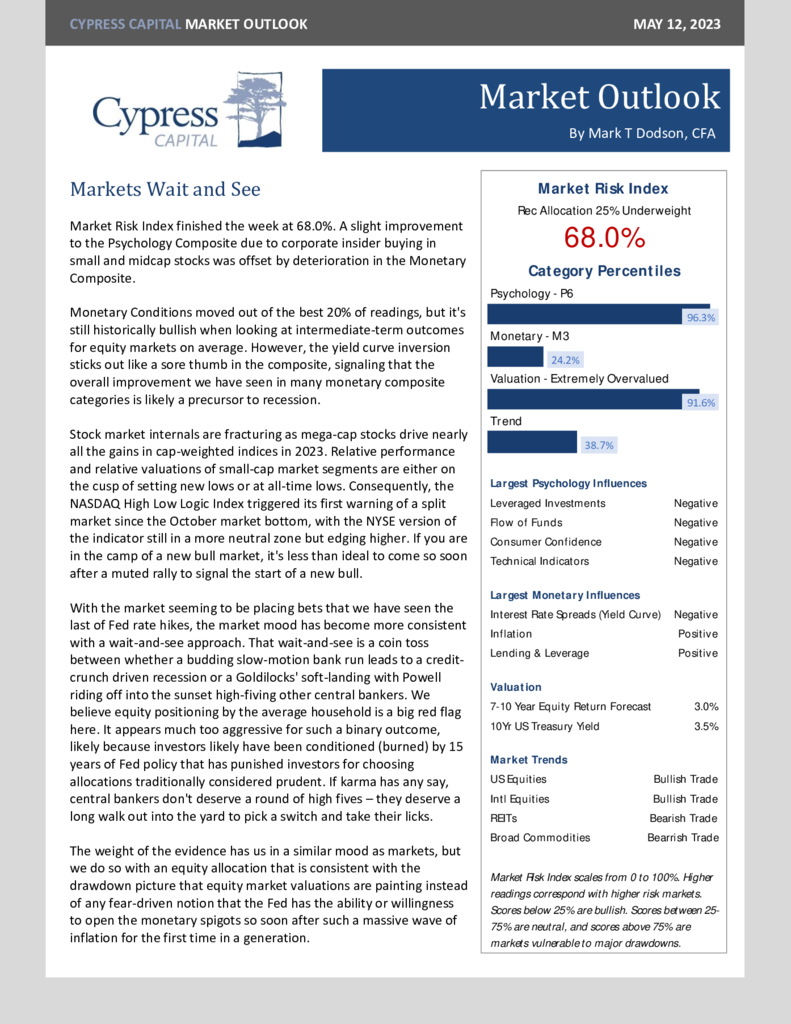

– Another advance by Large Growth stocks was insufficient to keep every other style and factor from dragging down cap-weighted indices.

– Latin America stood out, advancing 2.8% in a week when most equity markets declined.

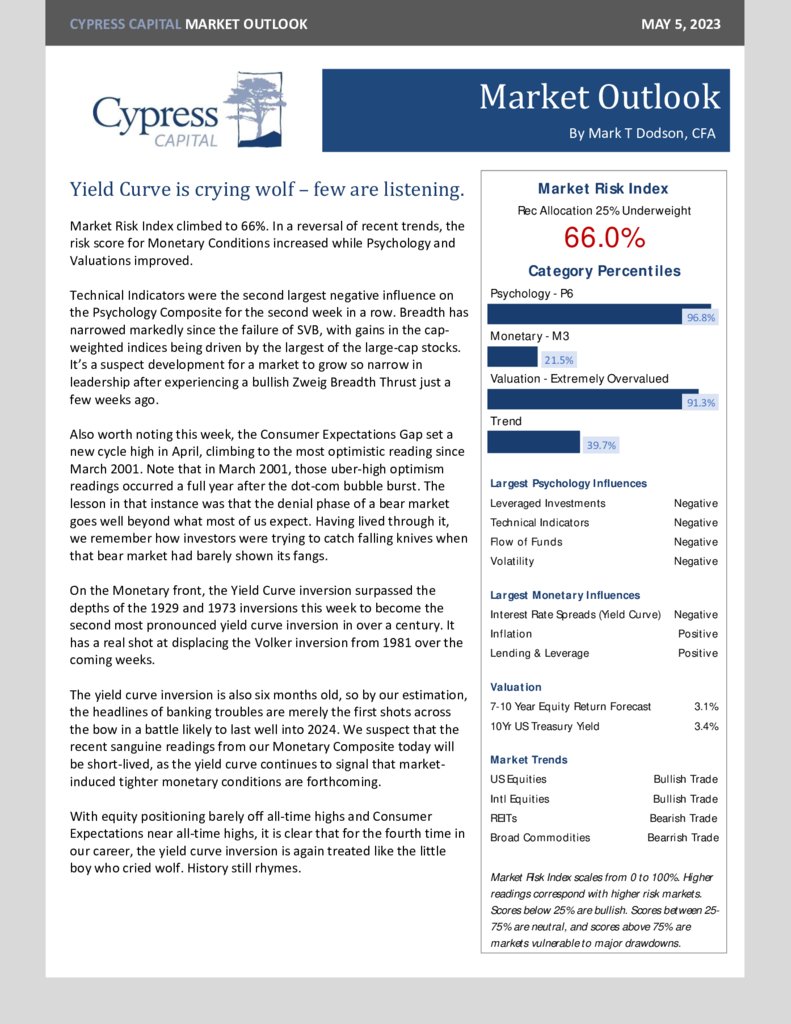

– Spreads between different durations of short-term Treasury Bills have been volatile over the last six weeks as debt-ceiling talks continue.