Archive

World Wrap

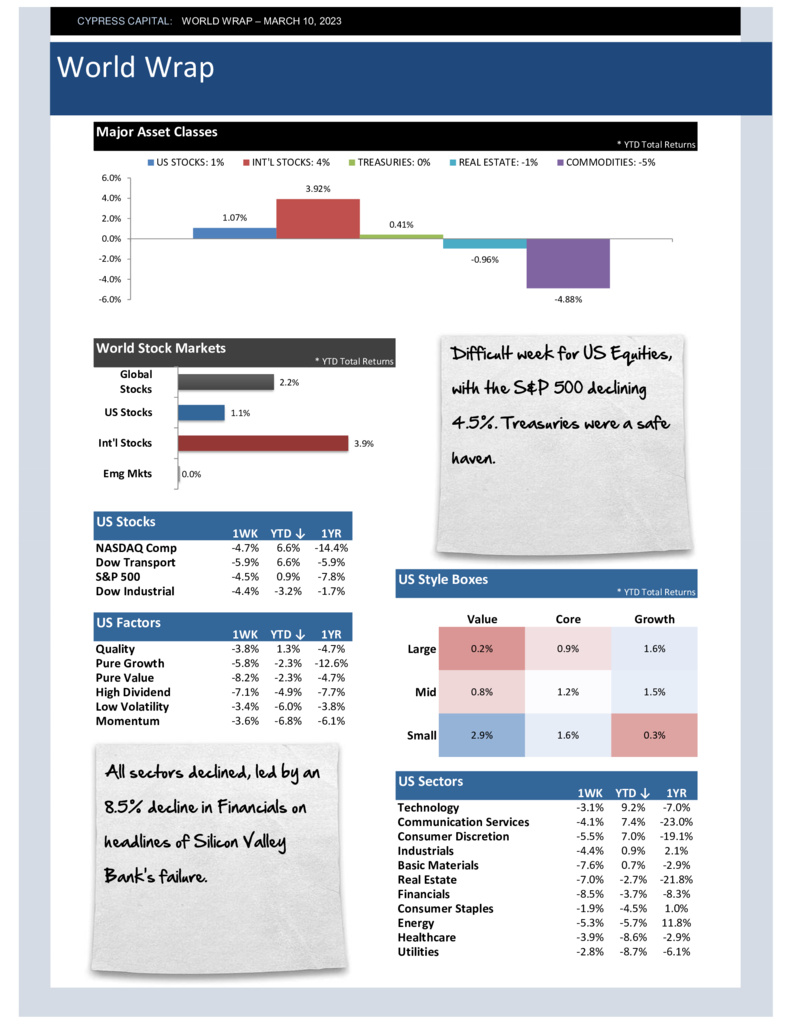

– Difficult week for US Equities, with the S&P 500 declining 4.5%. Treasuries were a safe haven.

– All sectors declined, led by an 8.5% decline in Financials on headlines of Silicon Valley Bank’s failure.

– A sharp 7.25% drop in China’s equity market has caused Emerging Markets to give up all their 2023 gains.

– The traditional flight to safety assets, US Treasuries and Gold, advanced in a week dominated by declining asset prices.

Market Outlook – Us Against the World

World Wrap

– Global financial assets bounced back last week after three consecutive weeks of declines.

– The broad market may be up, but four of eleven sectors are still down year to date.

– Deposits at US banks declined last year for the first time since 1948. High yields on T-Bills are encouraging savers to look elsewhere.

– Natural Gas rallied sharply by 18.1% but is still off by more than 28% since the start of the year.

%

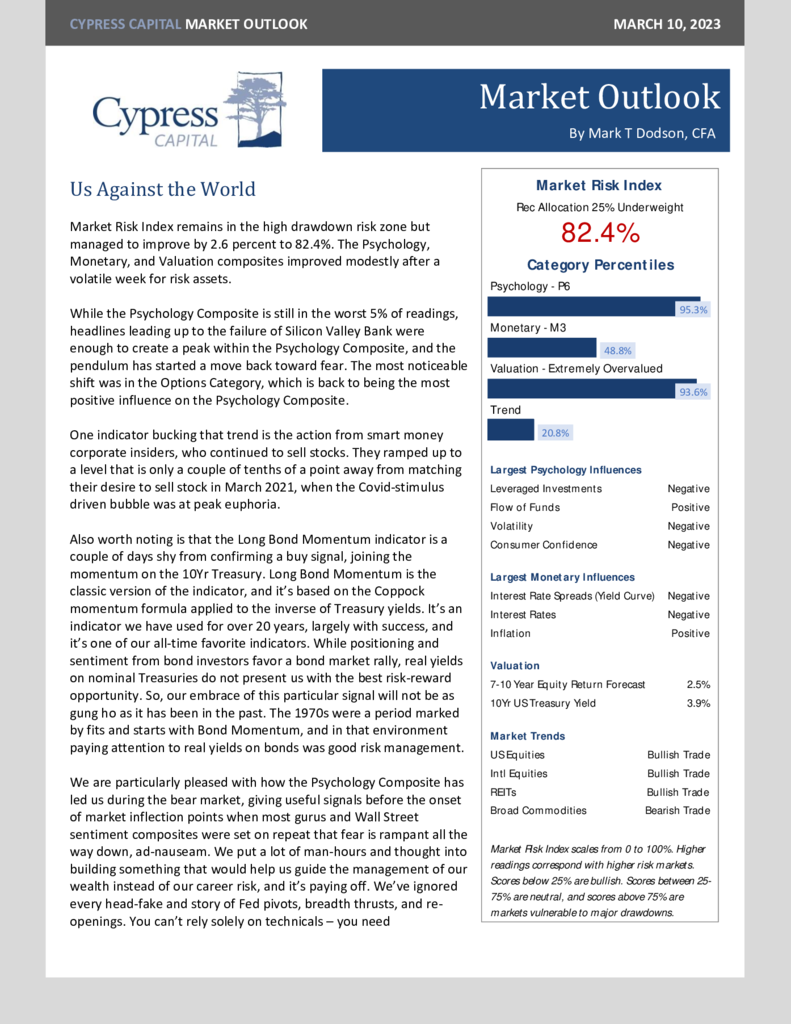

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%