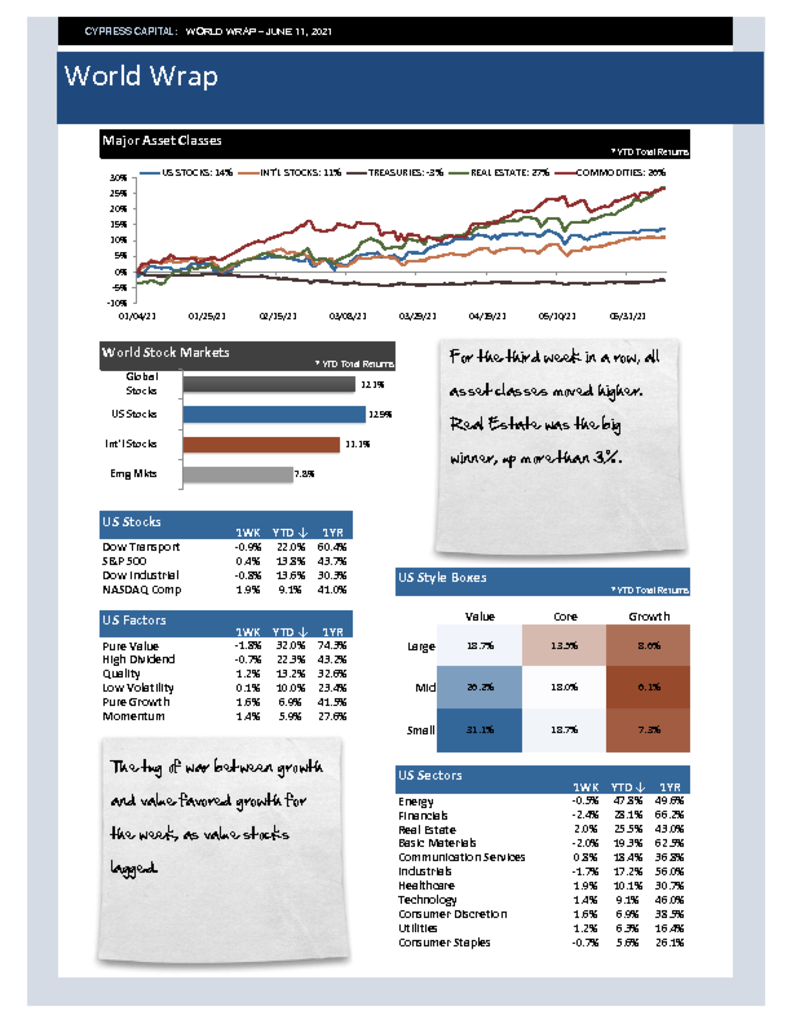

– For the third week in a row, all asset classes moved higher. Real Estate was the big winner, up more than 3%.

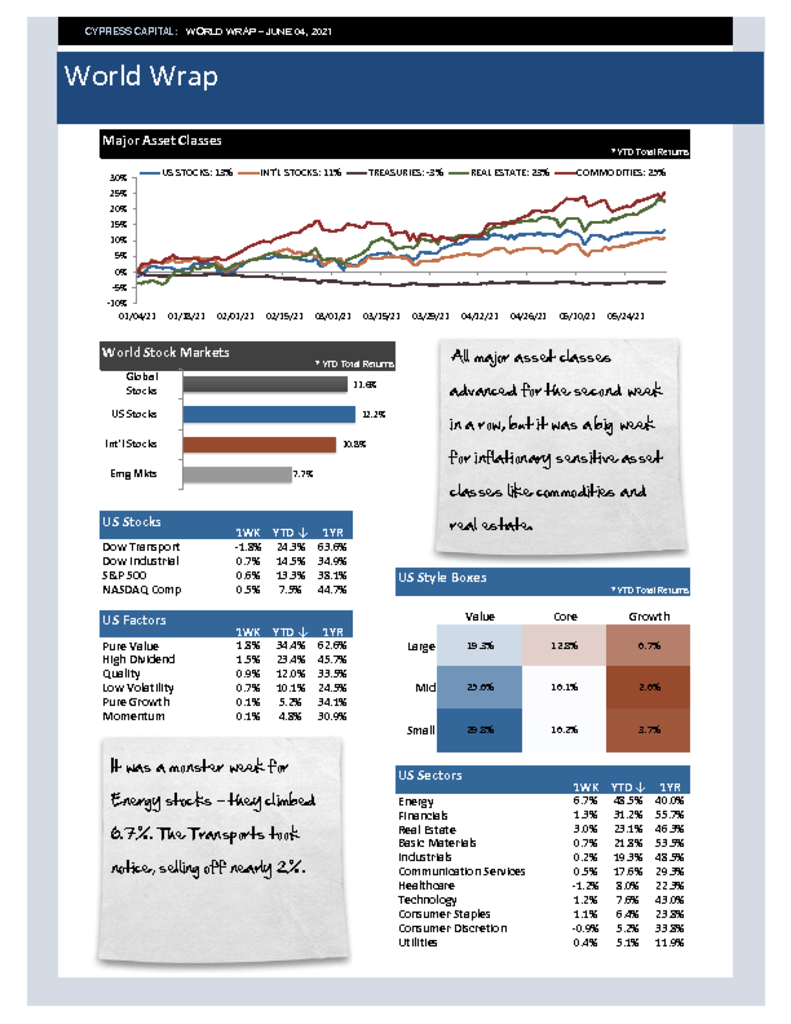

– The tug of war between growth and value favored growth for the week, as value stocks lagged.

– Peruvian stocks dropped 12.4% after socialist labor leader Pedro Castillo won Peru’s presidency.

– Lumber prices declined a whopping 17.5% last week and is now down more than 37% from the all-time high in May, assuaging some inflation concerns.