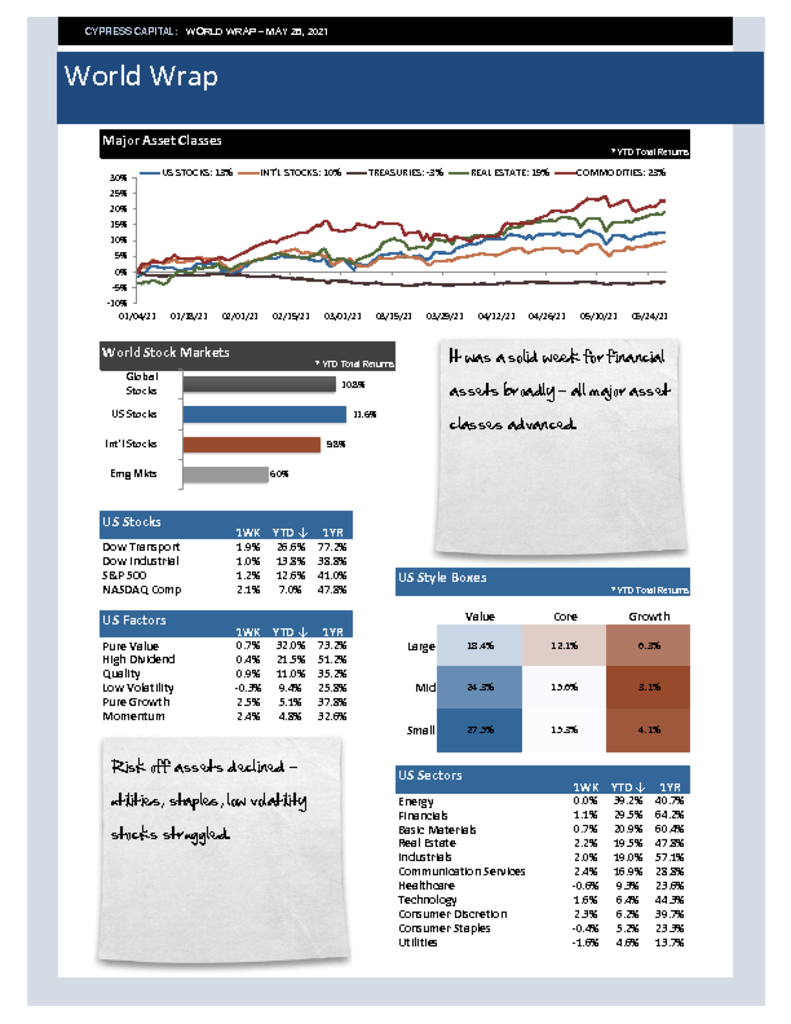

– It was a solid week for financial assets broadly – all major asset classes advanced.

– Risk off assets declined – utilities, staples, low volatility stocks struggled.

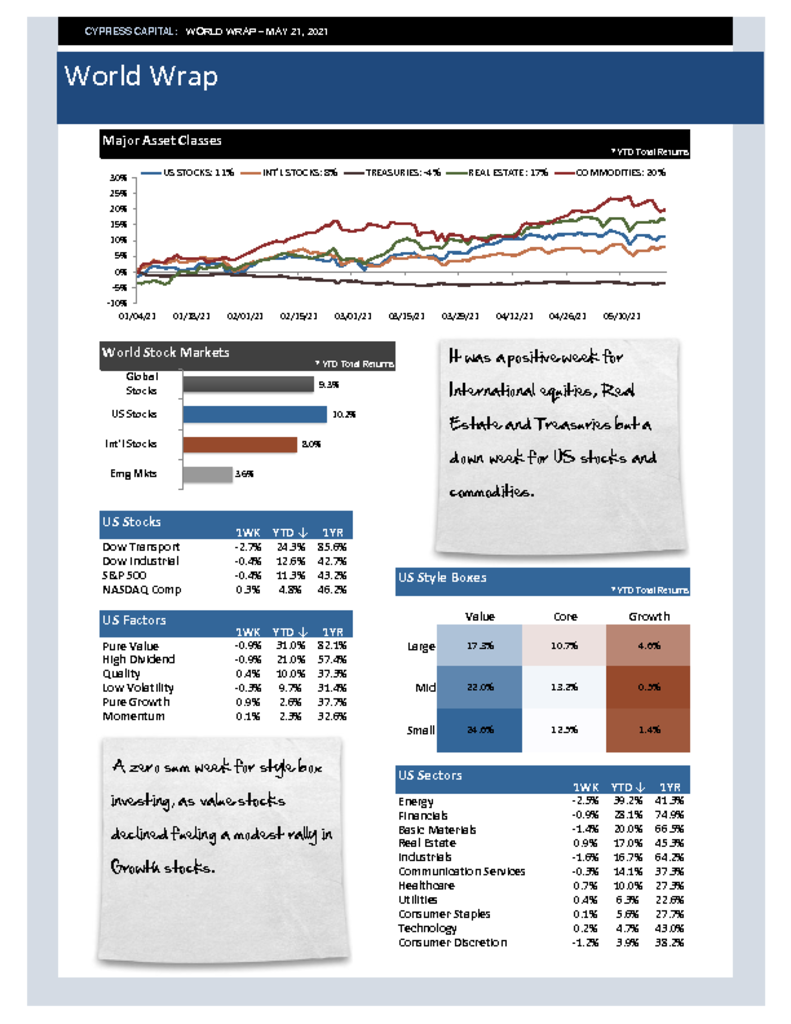

– Emerging markets outperformed again on another big week from China. China crossed into positive territory ytd.

– Has lumber finally peaked? It has declined more than 20% from its all-time high in early May.