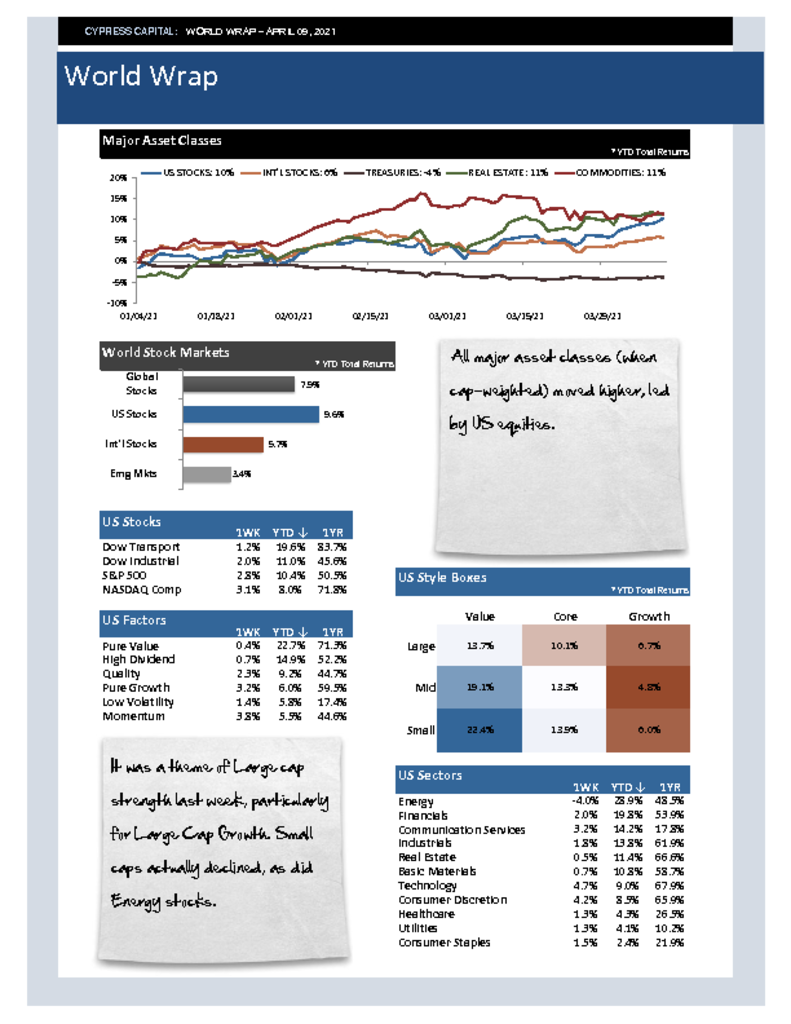

– All major asset classes (when cap-weighted) moved higher, led by US equities.

– It was a theme of Large cap strength last week, particularly for Large Cap Growth. Small caps actually declined, as did Energy stocks.

– Good week for developed mkts, but not emerging. China declined by more than 2%, as their attempt to normalize policy continues to weigh on equity prices.

– Lumber prices climbed another 10% to new all-time highs and are up nearly 250% over the last 12 months.