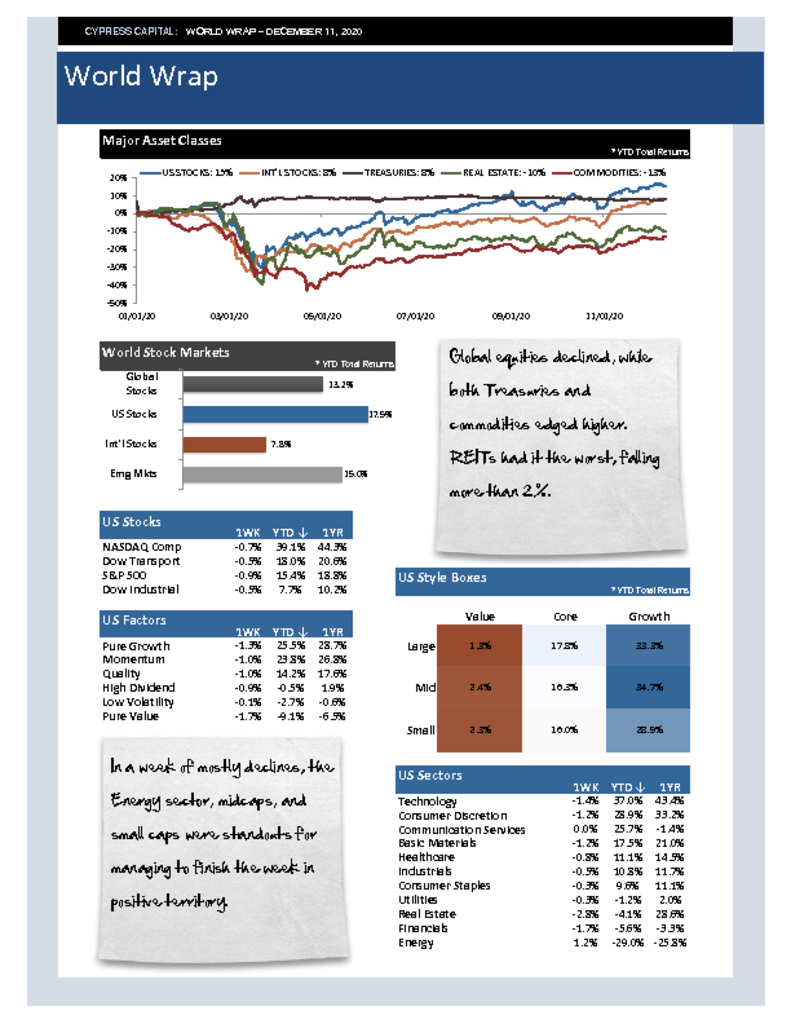

– Global equities declined, while both Treasuries and commodities edged higher. REITs had it the worst, falling more than 2%.

– In a week of mostly declines, the Energy sector, midcaps, and small caps were standouts for managing to finish the week in positive territory.

– The median country return was flat. Developed markets declined slightly, but Emerging markets were up. China declined again this week.

– 20Yr Treasury prices were up more than 2%, as the US dollar managed to buck recent trends and close higher.