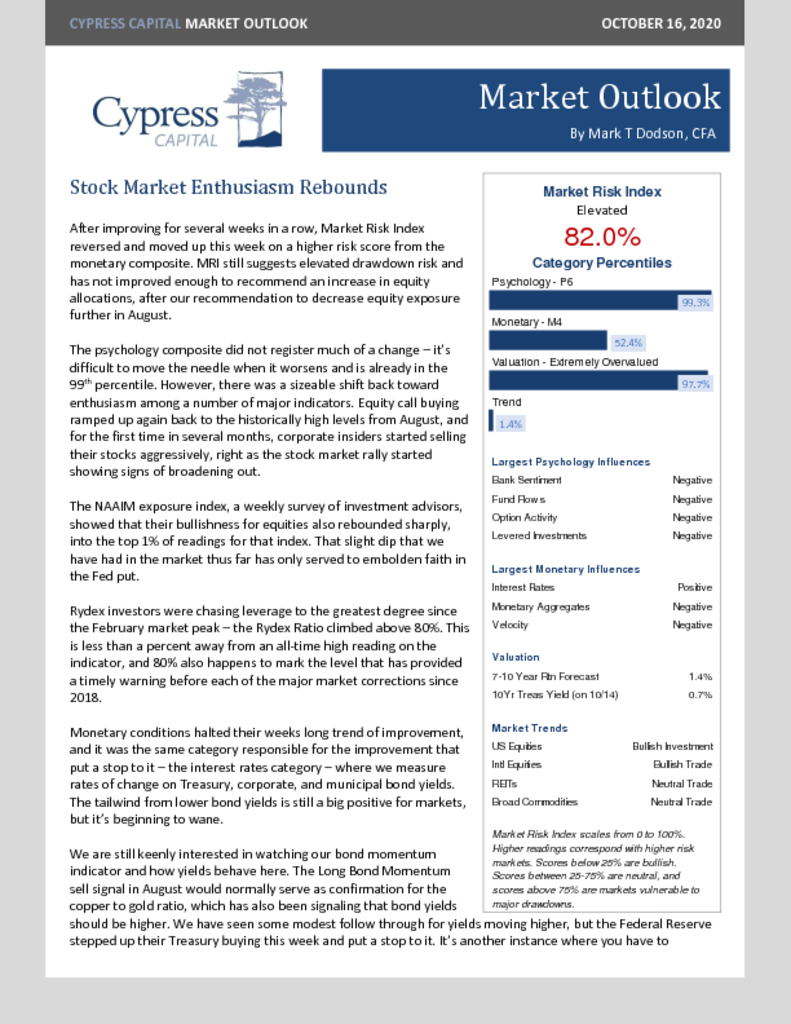

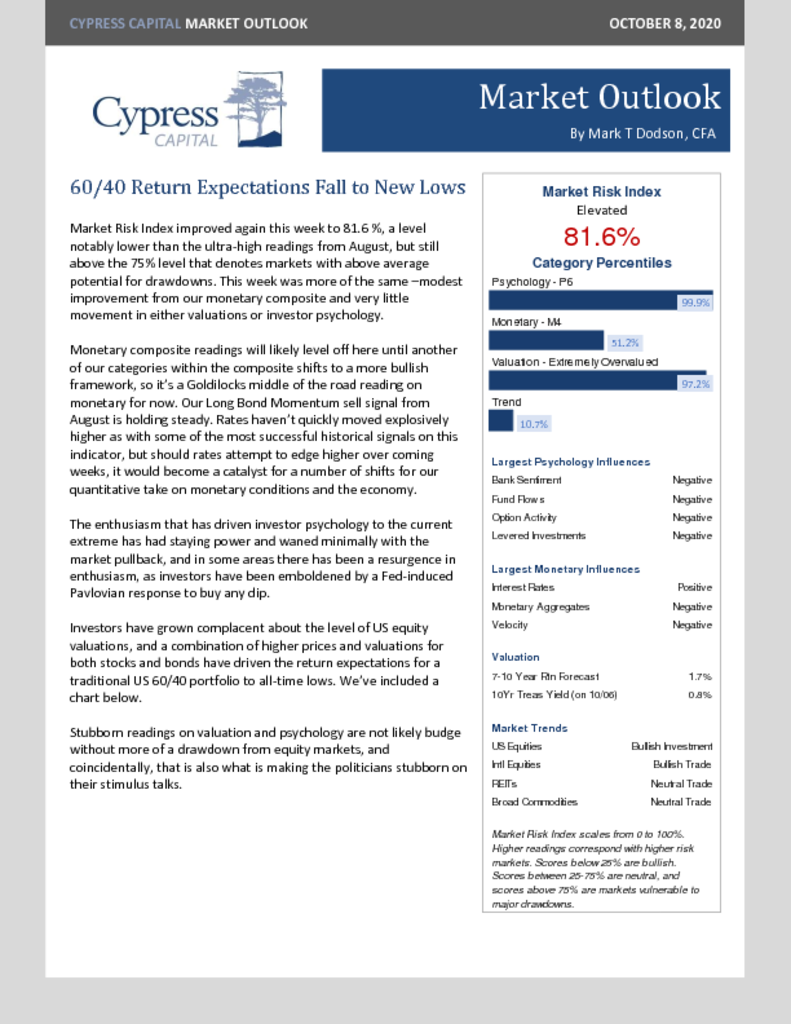

– Market Risk Index moves higher, mostly on a halt in the steady improvements in the monetary composite.

– Several signs of a rebound in stock market enthusiasm this week.

– Rydex Ratio hits key level that has served as a precursor to every major correction since 2018.

– Fed steps up bond buying this week, putting a stop to yields that were creeping higher.