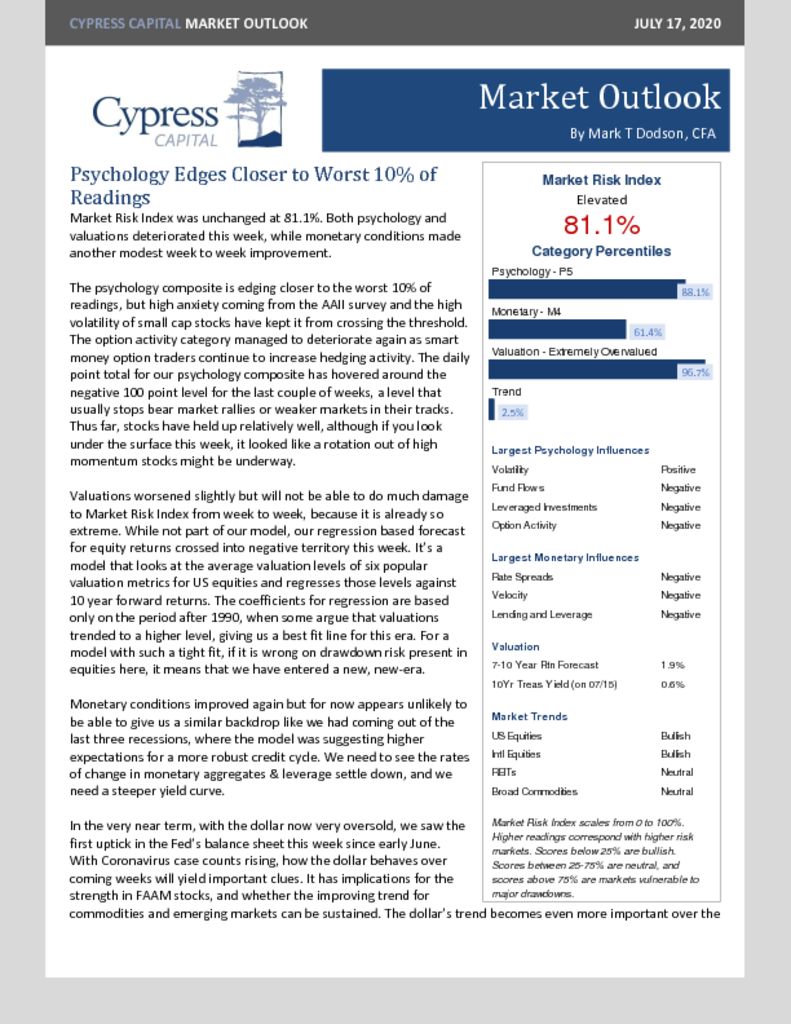

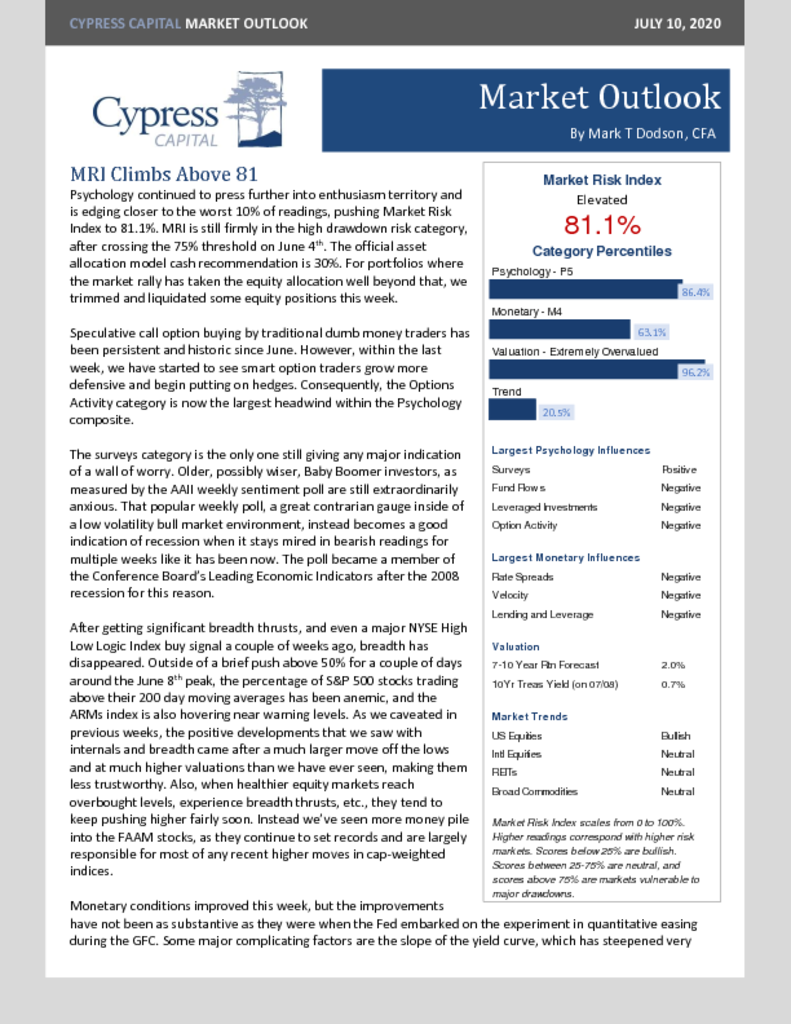

– Market Risk Index is unchanged at 81.1%

– Smart money option traders are increasing hedges in face of euphoric retail call option buying.

– Our regression based equity return forecast fell below 0% this week.

– The dollar’s short-term behavior is growing more important.

– …this week’s best charts.