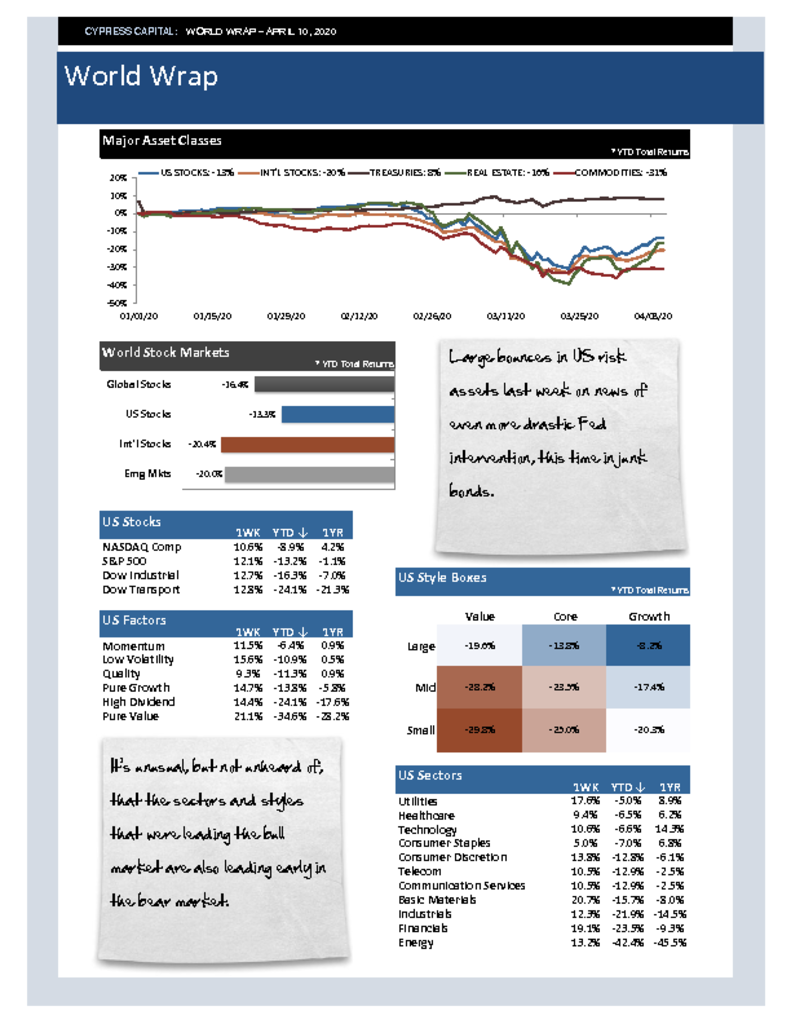

– Large bounces in US risk assets last week on news of even more drastic Fed intervention, this time in junk bonds.

– It’s unusual, but not unheard of, that the sectors and styles that were leading the bull market are also leading early in the bear market.

– Saudi Arabia, Russia, and US lead coalition to cut oil supply, but it may be too late to stem oversupply from sharp drop in demand.

– Neel Kashkari, Minneapolis Fed President, tried to temper expectations for a V-shaped economic recovery over the weekend, as Fed’s bal sheet surpasses $6T.