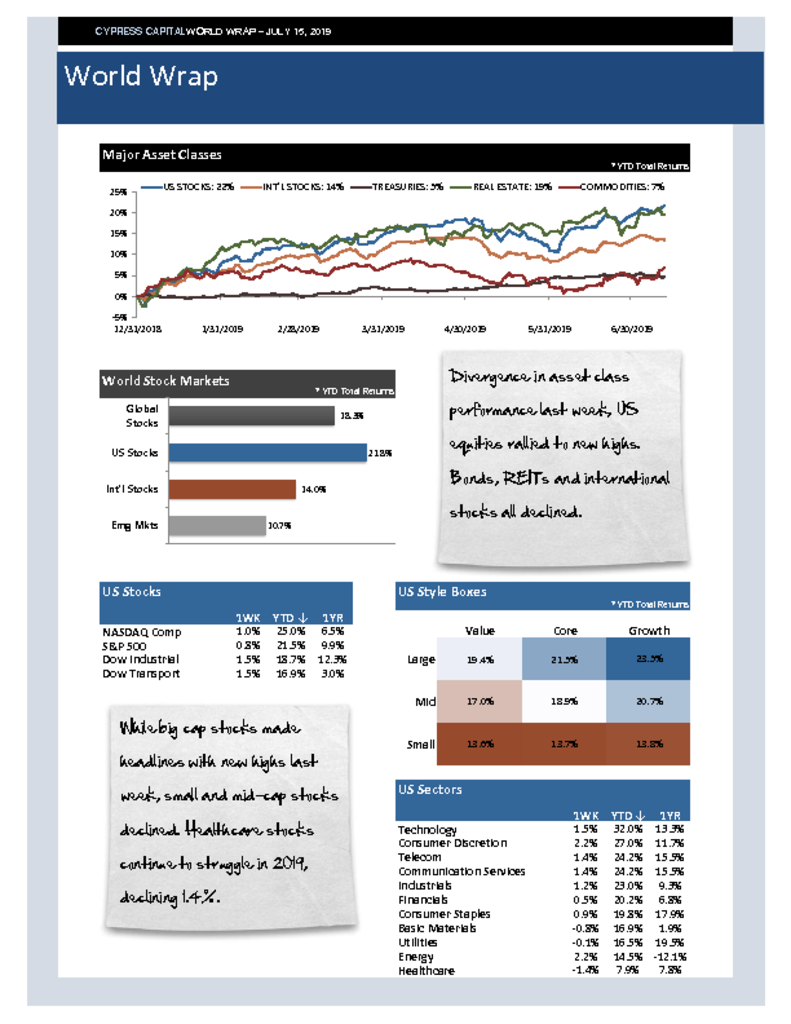

Divergence in asset class performance last week, US equities rallied to new highs. Bonds, REITs and international stocks all declined.

While big cap stocks made headlines with new highs last week, small and mid-cap stocks declined. Healthcare stocks continue to struggle in 2019, declining 1.4%.

China’s economic growth at its slowest in 27 years on trade tensions and lack of investment.

Crude oil rose almost 5% during the week, pushing broad commodity indices higher. Prices for long maturity Treasuries declined more than 1%.